This is a complete guide to case interview frameworks.

In this in-depth guide, you’ll learn:

- 11 must-know consulting frameworks to ace your case interviews

- How to use these frameworks in your case interviews

- And how to create custom frameworks

- Lots more

So, if you want to land an offer from a top consulting firm, this guide is for you.

Let’s dive right in.

Table of Contents

Get the latest data about salaries in consulting

What are case interview frameworks?

A case interview framework is a structured way to approach how to solve a problem.

In other words:

Case interview frameworks help Consultants (and aspiring Consultants) brainstorm and organize their ideas to solve complex problems.

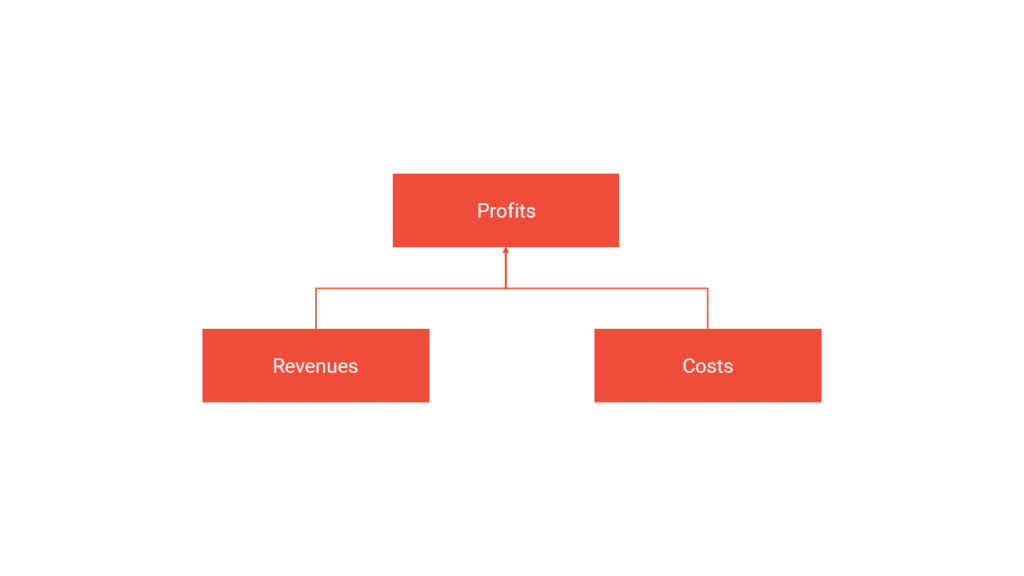

For example, a case interview framework is the profitability framework.

Let’s imagine this business problem:

Your client is manufacturing cars. And, for the past 2 years, they have been experiencing declining profits. They hire us to determine the root causes of this business problem.

And to help this company, you should explore the two main profit drivers: revenues and costs.

And explore if revenues decreased (one cause of declining profits).

Or explore if costs increased (another cause of declining profits).

Well… this (simple) example is a business framework.

Related articles

Check also these articles to ace your case interviews:

Ace market sizing questions (incl. 3 market sizing frameworks)

Let’s detail the 11 common case interview frameworks you must know to ace your case interviews.

And let’s start with Porter’s five forces.

Case interview framework 1: Porter’s Five Forces

Let’s start with an analysis of external factors.

And one of the most well-known business frameworks is Michael Porter’s Five Forces model.

And it can be found in the book Competitive Strategy: Techniques for Analyzing Industries and Competitors.

Michael Porter’s Five Forces model says the following:

Competitive advantage in an industry is dependent on five primary forces:

- The threat of new entrants

- How much bargaining power do buyers have

- The bargaining power of suppliers

- Threat of substitute products

- Rivalry with competitors

The degree of these threats determines the attractiveness of the market:

- An intense competition allows minimal profit margins.

- Mild competition allows wider profit margins.

Therefore, the goal is to assess whether a company should enter/exit the industry or find a position to defend itself against these forces best or influence them in its favor.

For instance, your market entry framework should include the components of Porter’s Five Forces.

The threat of new entrants (barriers to entry)

Several factors determine the degree of difficulty in entering an industry:

- Economies of scale

- Product differentiation

- Capital requirements vs. switching costs

- Access to distribution channels

- Cost advantages independent of scale

- Proprietary product technology

- Favorable access to raw materials

- Favorable location

- Government subsidies

- Learning curve

- Government policy

Relationship with buyers (buyer power)

- It is concentrated or large purchases volumes relative to the seller’s sales

- The products it purchases front the industry are standard or undifferentiated

- It faces few switching costs

- Buyers pose a credible threat of backward integration

- The industry’s product is unimportant to the quality of the buyer’s products or services

- The buyer has full information

- Purchasing potential

- Growth potential

- Structural position: intrinsic bargaining power and propensity to use it

- Cost of servicing

Relationship with suppliers (supplier power)

A supplier group is powerful if:

- It is not obliged to contend with other substitute products for sales in the industry

- The industry is not an important customer of the supplier group

- The supplier group is an important input to the buyer’s business

- The supplier group’s products are differentiated, or it has built up switching costs

- The supplier group poses a credible threat to forward integration

Key issues in purchasing strategy from a structural standpoint are as follows:

- Stability and competitiveness of the supplier pool

- An optimal degree of vertical integration

- Allocation of purchases among qualified suppliers

- The threat of backward integration

Substitute products

Substitute products that deserve the most attention are those that:

- Compete in price with the industry’s products

- Are produced by industries earning high profits

Rivalry among competitors (competitive analysis)

Now, let’s analyze the competitive landscape.

Rivalry among existing competitors increases if:

- Numerous or equally balanced competitors exist

- Industry growth is slow

- Fixed costs are high

- There is a lack of differentiation (commodity market)

- There are low switching costs

- Production capacity is augmented in large increments

To end this first section about Porter’s Five Forces, you can watch this video made by the channel Business To You.

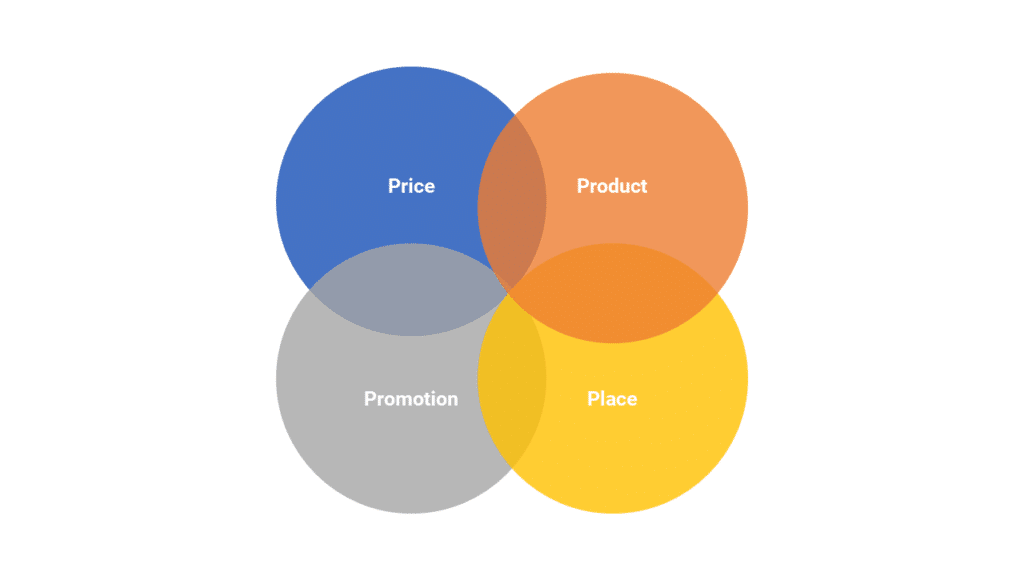

Case interview framework 2: the 4 P’s

The 4Ps are:

- Product

- Price

- Place

- Promotion

And it’s often seen as a Marketing framework.

The 4Ps framework can help you in your case interviews in one of the following situations:

- A market entry strategy or a product launch strategy

- To understand why sales (or market shares) have decreased

Now, let’s look at the different elements of the 4P framework.

Product

In examining the competitiveness of a company’s product, whether it is a new product being introduced on the market or an existing product manufactured by the company, one must examine the product itself.

The following are some of the questions you might find helpful in assessing a product’s competitiveness:

- Does the product serve a particular market segment? Is it a mass market or a niche product

- Is it differentiated enough to stand out against the competition? If yes, how? If not, what can be done to improve its value perception?

- What features can be added to the product that would add to the perception of value to the consumer?

- What are some of the packaging issues that might present an opportunity or impediment to increased sales?

- Does my packaging reflect the positioning of the product?

- Does the product have patent protection?

- What financial role is the product playing (i.e., cash cow, long-term profit potential, etc.)?

- Are there any other products that can act as substitutes?

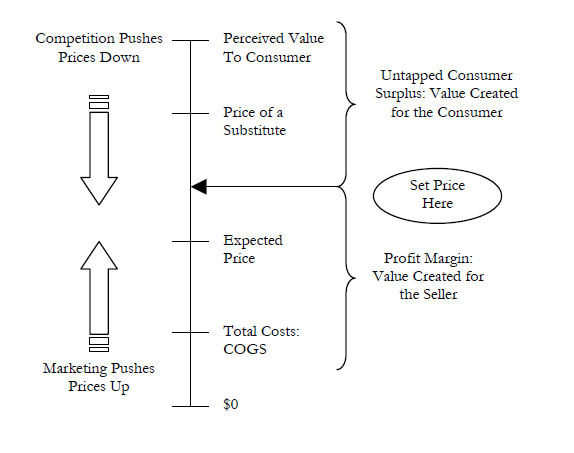

Price

Getting the right price for a product is extremely important for the company’s success.

Unfortunately, sometimes the right price is not easy to determine.

Depending on the price elasticity of the product, a 1% increase in price has anywhere from a -20% reduction to a 25% increase in net income.

The most important factor that drives price is the customer’s perceived “value” of the product.

This is also known as the customer’s willingness to pay.

For example, if a company produces shirts with a unit cost of $10, but the market perceives the product as fashionable or has the right brand name, the shirt can be priced to capture any consumer surplus at $50 or even $80 per shirt.

The same manufacturer introduces another shirt at the same cost the following season.

This time, however, the shirt is no longer considered in vogue and thus has little “value.”

This time, the shirt would be priced at $25.

Other factors determining a product’s price are:

- The Cost to Produce COGS: maintain low costs to capture a bigger profit margin.

- The price paid previously – the expected price: if consumers are used to paying a certain price for a product, it is challenging to convince them to pay a $20 premium for the same product. However, if their perceived product value is higher than what they paid in the past, there’s room to capture some consumer surplus.

- The price of substitutes: the price of a product is driven down if the product can be easily substituted by another that serves the same function.

Place

After assessing the product positioning and understanding who your customers are, you need to develop a strategy around which distribution channel to use and where to sell your product.

The distribution channel can be through a third party or an in-house sales force.

And the distribution channel is responsible for transmitting the company’s product to the customer (wholesaler, retailer, end-user).

The selected distribution channel and the outlets at which the product is sold MUST be aligned with the product’s positioning and focused customer segment.

There are many issues to consider when examining the place/channel distribution.

Below are some thoughts to formulate a strategy for delivering the product to market:

- What are the customer preferences regarding distribution?

- Which channels most closely align with the company’s strategy?

- Does the company need to build new channels or eliminate existing ones?

- Does it make more sense to go direct to the end-user or deliver the product through intermediaries?

- What are the economics of the channel?

- What would be the relationship of the company’s sales force in this arrangement?

- How would the company address any potential shifts in power to the channel?

- How do competitors distribute their products?

Promotions

Promoting and developing a specific brand for the product has many benefits:

It develops a certain perception of the product in consumers’ eyes.

The product’s success will depend on the message conveyed to the consumer and what that consumer ultimately believes about the product.

To maintain a certain perception of exclusivity, traditional advertising (mass or niche), refraining from advertising, word-of-mouth marketing, direct mail, etc., can all be included in promotion and branding.

Here is a list of issues worth analyzing in case interviews:

- How is the marketing strategy different from the competition?

- What message are we trying to communicate? What is the objective?

- Where are we advertising our product (newspapers, TV, radio, Internet, etc.)?

- Pull strategy: (direct at end-user) use of advertising, direct mail, telemarketing, word of mouth, and consumer promotions.

- Push strategy: trade promotions, sales aids, and sales training programs

- How much money is allocated to marketing?

- How are competitors marketing their products?

Related articles

Check also these articles to ace your case interviews:

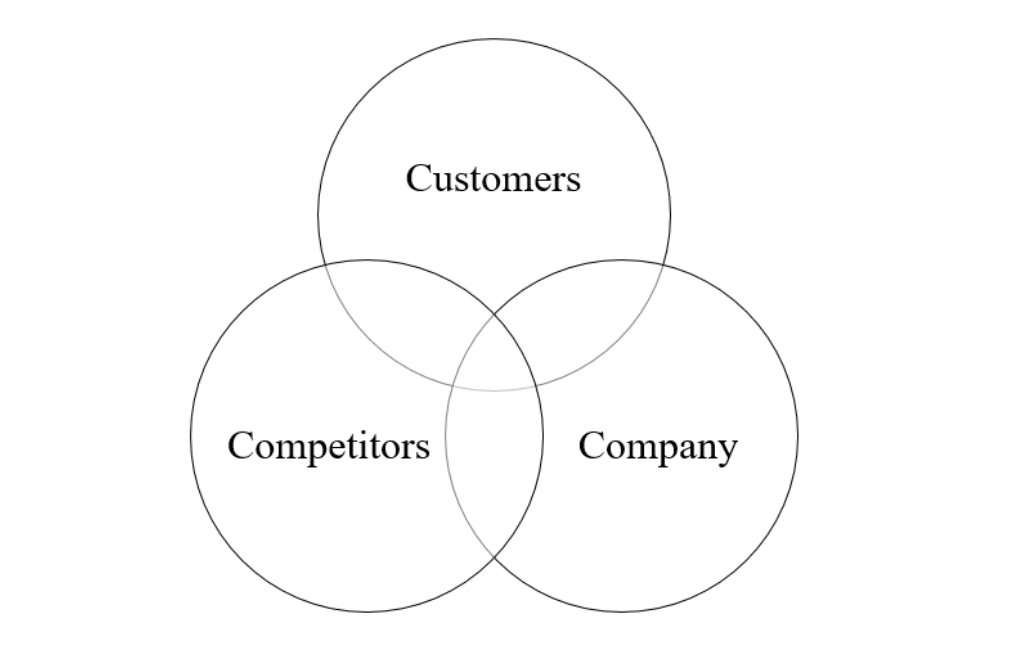

Case interview framework 3: the 3 C’s

Knowing the 3C framework and the details upon which the framework is based is crucial to cracking the case.

For instance, the 3C framework is often used to assess the business landscape.

Or by simply defining a growth strategy.

For instance, your market entry framework should include the 3C’s.

By analyzing the three elements, Consultants can identify the key success factors and create a viable marketing strategy.

DO NOT attempt to tackle a case during the interview by saying, “I would like to use the 3Cs framework…”

Before you even finish your sentence, the interviewer will have decided to reject you.

This point will be emphasized many times during this guide.

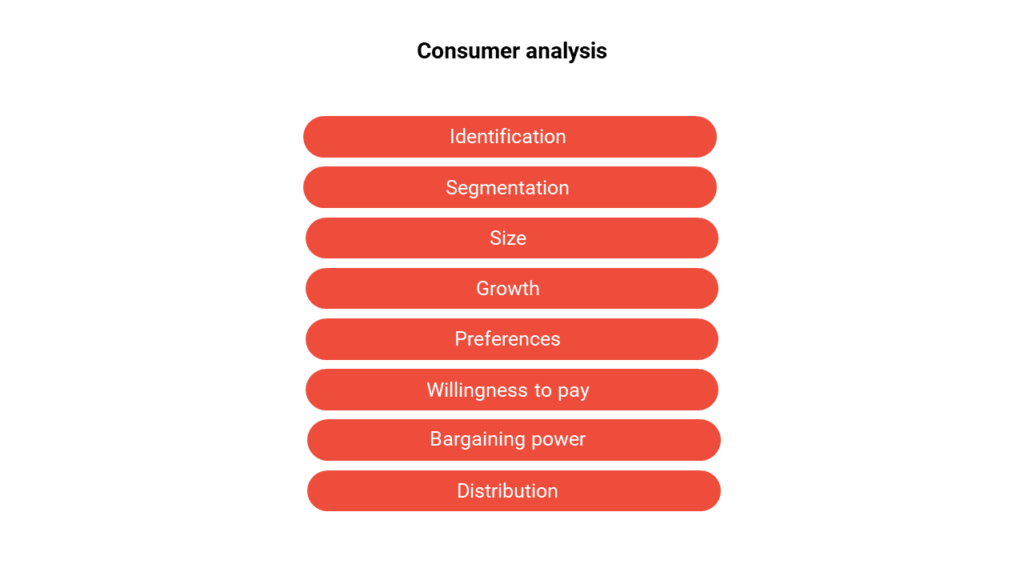

Consumers

A good first step in assessing the business landscape is to examine the customer, the people whose problems the industry is trying to solve.

Below are eight factors to consider when examining the customer.

#1: Customer Identification

Who is the customer?

In trying to identify the customer, remember that the person who makes the purchase decision, the person who pays (the customer), and the end user (the consumer) may all be different people.

For example, a doctor may prescribe medicine that will be paid for by an insurance company (the customer) and ultimately used by a patient (the consumer).

#2: Customer Segmentation

Is it possible to group customers into distinct segments?

Customer segmentation can make it easier to understand customer needs and preferences, the size and growth rate of different revenue streams, and to identify trends.

It may make sense to segment customers by:

1. Age group

2. Gender

3. Income level

4. Employment status

5. Distribution channel

6. Region

7. Product preference

8. Willingness to pay

9. New versus existing customers

10. Large versus small customers.

#3: Size

How big is the market?

How big is each customer segment?

How many customers are there in each segment, and what is the dollar value of those customers?

#4: Growth

How fast is the market growing?

What is the growth rate of each customer segment?

#5: Customer Preferences

What do customers want?

Do different customer segments want different things?

Are the needs and preferences of customers changing over time?

#6: Willingness to Pay

How much is each customer segment willing to pay?

How price sensitive is each customer segment?

For example, students will normally be very price sensitive, which means that offering student discounts can increase units sold by enough to increase total revenue.

#7: Bargaining Power

What is the concentration of customers in the market relative to the concentration of firms?

If there is a small number of powerful customers who control the market?

Then it may be necessary to either play by their rules or search for a more favorable market.

Do customers face high switching costs?

If customers face high switching costs, this will reduce their bargaining power and allow firms to charge higher prices than would otherwise be possible.

#8: Distribution

What is the best way to reach customers?

Does each customer segment have a preferred distribution channel?

Get 4 Complete Case Interview Courses For Free

You need 4 skills to be successful in all case interviews: Case Structuring, Case Leadership, Case Analytics, and Communication. Join this free training and learn how to ace ANY case questions.

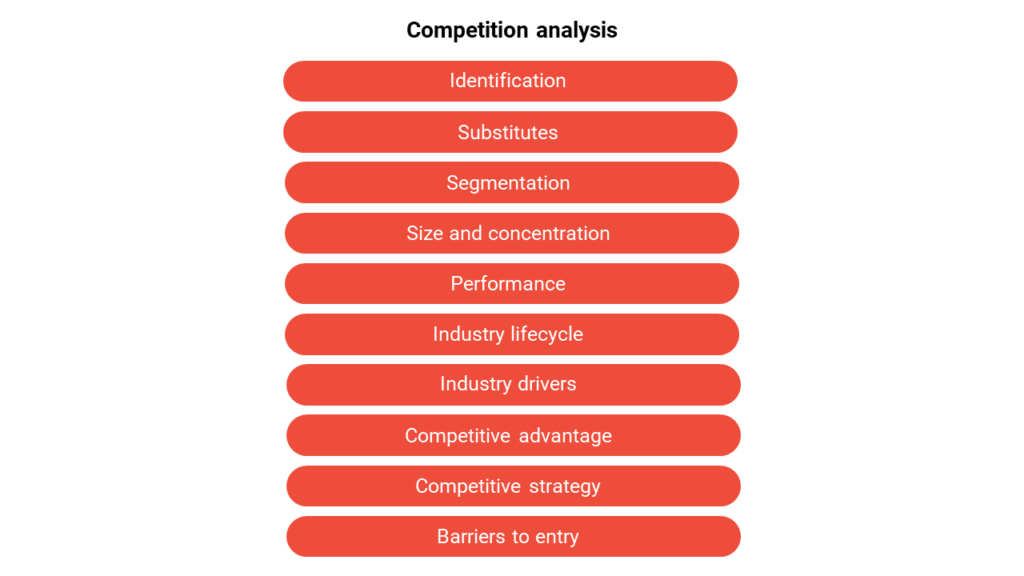

Competitors

It is also important to understand the business landscape to understand the competition.

Competition can come from firms within an industry offering similar solutions to the same group of customers (for example, Pepsi and Coca-Cola).

But, competition can also come from firms in other industries who produce substitutes.

Substitutes may have quite different characteristics (for example, petroleum and natural gas).

Still, they represent a form of indirect competition because consumers can use them in place of one another (at least in some circumstances).

For example, petroleum and natural gas might produce heat and energy.

Below are ten factors to consider when examining the competition.

#1: Competitor Identification

Who are the company’s major competitors?

Taking Cadbury as an example, some of its major competitors might include Lindt, Ferrero, Nestlé, Hershey’s, and Mars.

What products and services does the competition offer?

#2: Substitutes

Who are the company’s indirect competitors? That is, which firms are producing substitutes?

Identifying indirect competitors helps to take a broader view of what the company offers.

For example, Cadbury sells chocolate.

But it might be considered a snack food company.

So indirect competitors might include companies like Lays, Cheetos, and Doritos.

#3: Competitor Segmentation

Is it possible to segment competitors in a meaningful way?

The competition might be grouped by distribution channel, region, product line, or customer segment.

#4: Size and Concentration

What are the revenues and market shares of major competitors?

What is the concentration of competitors in the industry?

Are there many small competitors (a low-concentration industry) or a few dominant players (a high-concentration industry)?

Examples of high-concentration industries include oil, tobacco, and soft drinks.

Examples of low-concentration industries include wheat and corn.

#5: Performance

What is the historical performance of the competition?

Relevant performance can be profit margins, net income, and return on investment.

#6: Industry Lifecycle

Where is the industry’s lifecycle (early stage, growth, maturity, or decline)?

#7: Industry Drivers

What drives the industry: brand, product quality, the scale of operations, or technology?

#8: Competitive Advantages

What is the competition good at?

How sustainable are these advantages?

What are the competition’s weaknesses? How easily can these weaknesses be exploited?

#9: Competitive Strategy

What strategy is the competition pursuing?

Is the competition producing products that are low-cost or differentiated?

What customer segments is the competition targeting?

What are the competition’s pricing and distribution strategies?

What is the competition’s growth strategy?

Are they seeking growth by focusing on customer retention, increased sales volume, entering new markets, or launching new products?

#10: Barriers to entry

Key barriers to entry include capital requirements, economies of scale, network effects, product differentiation, proprietary product, technology, government policy, access to suppliers, access to distribution channels, and switching costs. (see Porter’s five forces model).

Company

In assessing the business landscape, it is not enough to understand the customer and the competition.

Understanding the firm from whose perspective you are analyzing the industry is also important.

Below are ten factors to consider when examining the company.

#1: Performance

What is the historical performance of the company?

What is its market share?

If profits are falling, what is the cause of the issue?

#2: Competitive Advantage

What resources and capabilities does the company possess?

Consider tangible assets (property, plant, equipment, inventory, and employees) and intangible assets (brand, patents, copyrights, and specialized knowledge).

How sustainable are the company’s advantages? What are the company’s weaknesses, and can they be remedied?

#3: Competitive Strategy

What is the company’s competitive strategy?

Is the company producing products that are low-cost or differentiated?

Which customer segments does the company target?

What are the company’s pricing, distribution, and growth strategies?

#4: Products

What does the company offer, and how does it benefit consumers?

Does the product have any downsides or side effects?

Is the product differentiated?

How does the company’s product offering compare with the competition?

Are there substitutes available?

Do customers face high switching costs?

#5: Finances

If the company is considering a particular course of action, does it have sufficient funds available?

Financing may be secured from various sources, including internal cash reserves, bank loans, shareholder loans, bond issues, or the sale of shares.

How many units will the company need to sell to cover the cost of the project?

Is there sufficient market demand?

#6: Cost Structure

To understand a company’s cost structure, it helps to break each business unit down into the collection of activities performed to produce value for customers.

How each activity is performed, and its economics will determine a firm’s relative cost structure within its industry.

Are costs predominantly fixed or variable?

How does this compare with the competition?

#7: Organisational Cohesiveness

Understanding a firm’s inner workings is important since competitive strategies can fail if they conflict with its culture, systems, and general business.

The organizational aspects of a firm can be examined using the McKinsey 7 S Model.

#8: Marketing

How do customers perceive the company and its products?

How does the company communicate with customers?

#9: Distribution Channels

What distribution channels does the company use to reach customers?

Are there other channels that are more cost-effective or preferred by customers?

#10: Customer Service

Does the company have a customer loyalty program?

How does the company interact with customers and support its customers post-sale?

Are employees empowered to solve problems and delight customers?

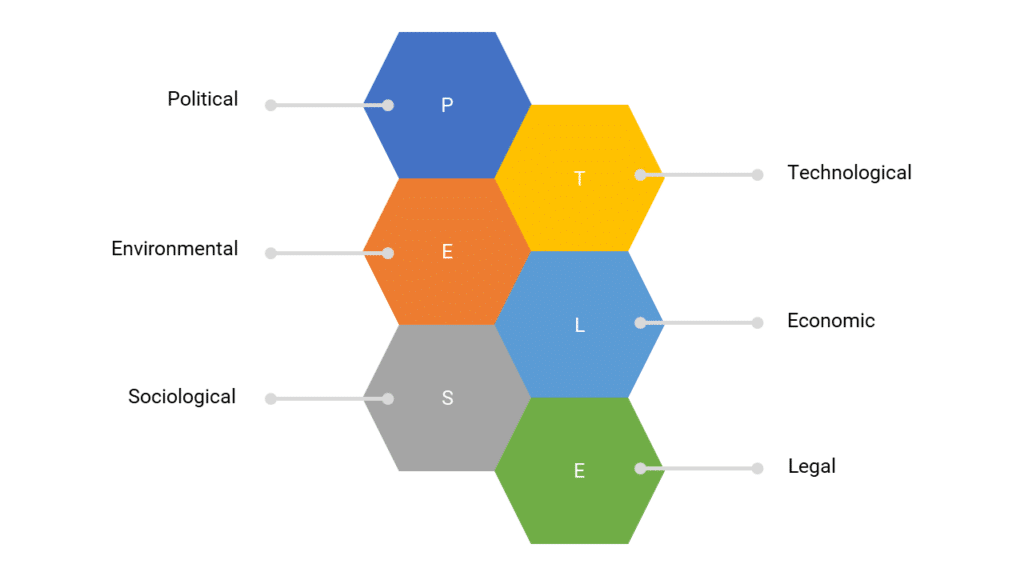

Case interview framework 4: PESTEL (or PESTLE)

PESTEL is an acronym for five factors – Political, Economic, Social, Technological, Legal, and Environmental – that can influence a company’s performance or strategic decisions.

A PESTEL analysis examines these external forces that can have strategic implications for the company.

And conducting a PESTEL analysis can be helpful for three reasons:

Understanding the facts: Understanding the big picture can help a business make informed decisions and avoid incorrect assumptions based on past experience.

Anticipating change: Understanding the macro environment can help a business identify trends and anticipate change, allowing it to take advantage of opportunities and manage potential threats.

Avoiding failure: Understanding the macro environment can help a business (and its investors) to identify projects that are likely to fail due to unfavorable conditions.

Below is a list of some of the general issues the interviewee should consider:

Political forces

- Are there any legal or political restrictions, such as new legislation, that would impede the product’s sale?

- What regulations must be addressed before introducing the product (health regulations/antitrust, etc.)?

Economic factors

- Has the economy’s overall performance impacted the sale of my product? Interest rate? Unemployment figures? Exchange rates? Balance of Payments? Free-Trade Agreements?

Socio-cultural forces

- What norms/cultural practices should be considered when entering a new market?

- Are there any trends in religious practices/traditions/rituals that should be considered?

Technological factors

- What are some of the technological trends in the market that could help/diminish the sale of the product (e.g., paper-based media vs. internet)?

- What R&D advancements were made by the market that would have a long-term impact on the very survival of the company (e.g., pay-per-view video vs. video stores)?

Environmental factors

- How does the business affect the environment?

Legal factors

- Are there any legal or political restrictions, such as new legislation, that would impede the product’s sale?

- What regulations must be addressed before introducing the product (health regulations/antitrust, etc.)?

Finally, the folks from the YT channel Business To You have made a great video about the PESTLE model:

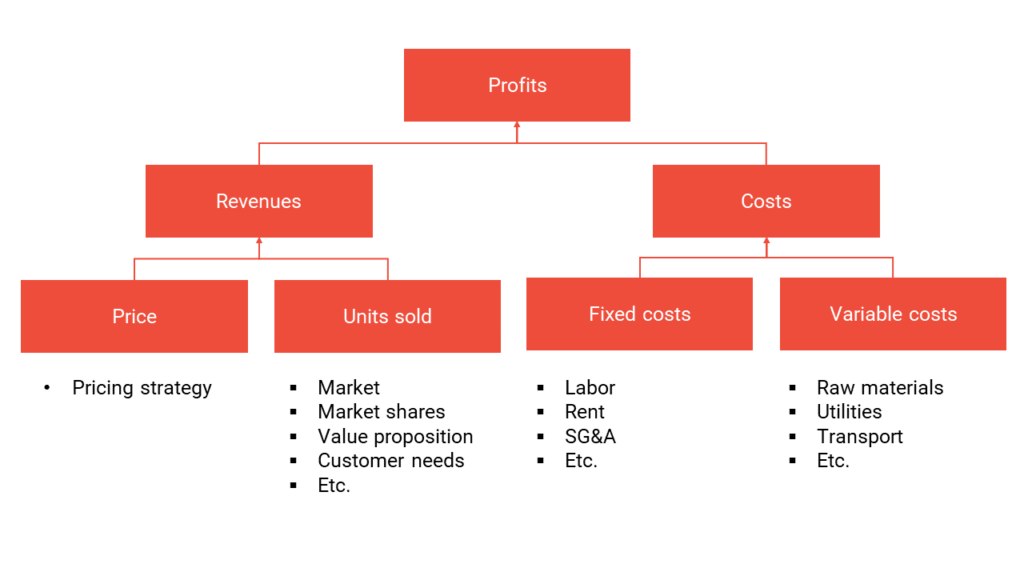

Case interview framework 5: Profitability framework

There’s a good chance that the cases discussed during the interview will often touch on issues of declining profitability.

This framework is very helpful in organizing your thoughts and methodically approaching profitability problems.

According to the Profitability Framework’s opening statement, profit is a function of revenue and costs.

A company’s profitability declines when revenue has dropped, costs have risen, or both.

The goal is to identify the component of the equation that is reducing profitability and determine the best course of action for fixing it.

A quick note:

Variable costs are costs that vary with the units sold.

Fixed costs are costs that do not vary with the units sold.

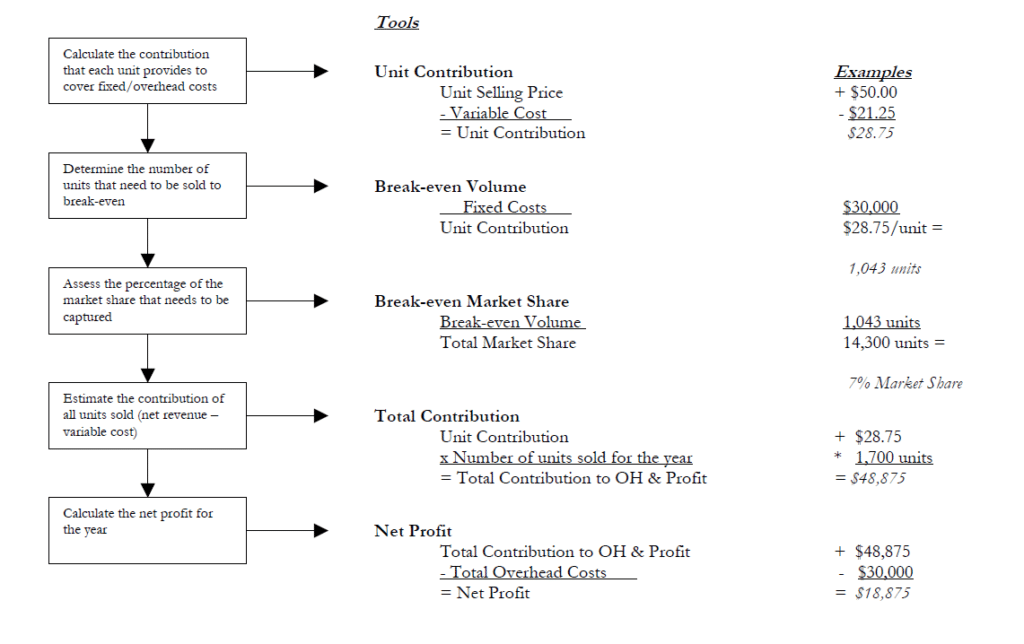

Case interview framework 6: Unit contribution

The following is a framework you can use to help you understand the economics of the product’s contribution.

This framework is critical when forecasting the overall success of the product.

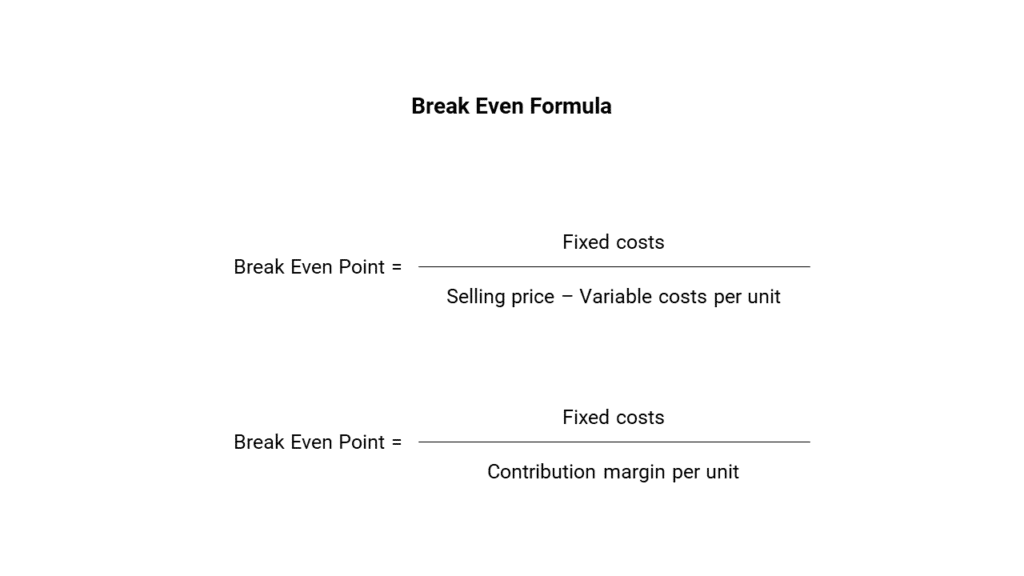

Case interview framework 7: Break Even

A break-even analysis tells you how many units of a product must be sold to cover the fixed and variable production costs.

For instance, this is important when deciding whether to launch a new product.

Also, a break-even analysis concerns a product’s contribution margin (selling price minus variable costs per unit; see the previous section).

So, the contribution margin is the excess between the selling price of the product and the total variable costs.

For example, if an item sells for $100, the total fixed costs are $25 per unit, and the total variable costs are $60 per unit, the product’s contribution margin is $40 ($100 – $60).

This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin.

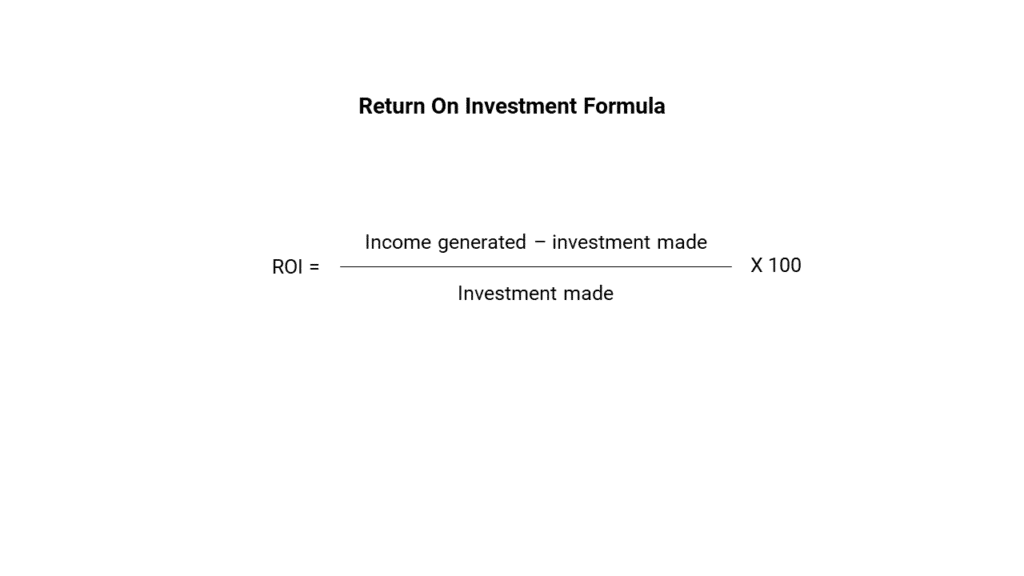

Case interview framework 8: ROI

ROI is an acronym for Return On Investment.

The ROI is a performance measure that a company can use to evaluate the return from an investment or to compare the returns of several different investments.

For example, if you spent $10,000 and made $15,000, your ROI would be 50%.

[ ( $15,000 – $10,000 ) / $10,000 ] x 100% = 50%

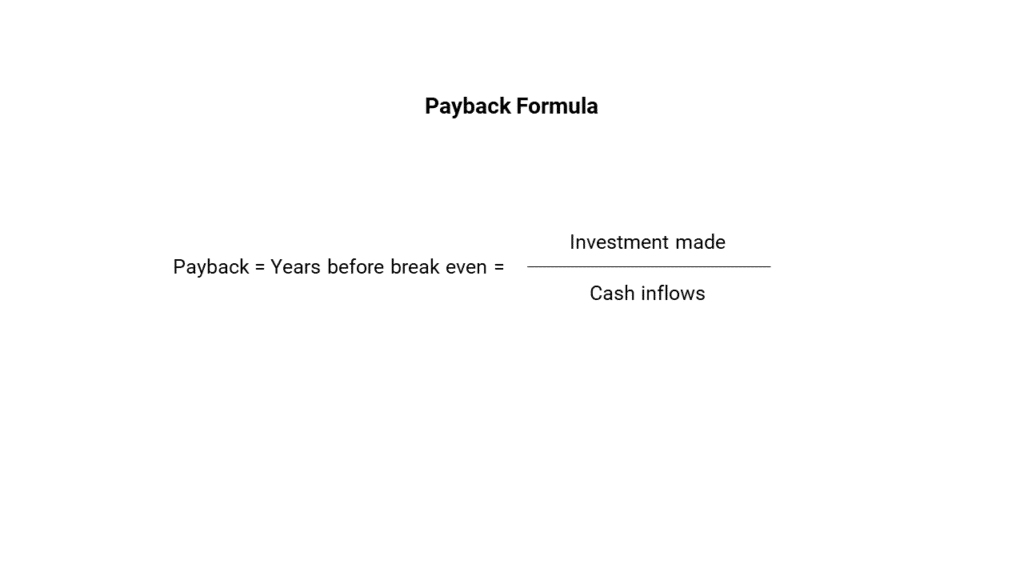

Case interview framework 9: Payback

A payback period is the time needed to recover the cost of an investment.

Simply put, it is the time an investment reaches a breakeven point.

For example, if a company invests $300,000 in a new production line, and the production line then produces a positive cash flow of $100,000 per year, then the payback period is 3 years.

Another example:

You are offered to invest in the project $120K.

The project will bring on average $30K a year in net profit.

Using the payback formula, we get a payback period for capital invested of four years (we divided 120,000 by 30,000).

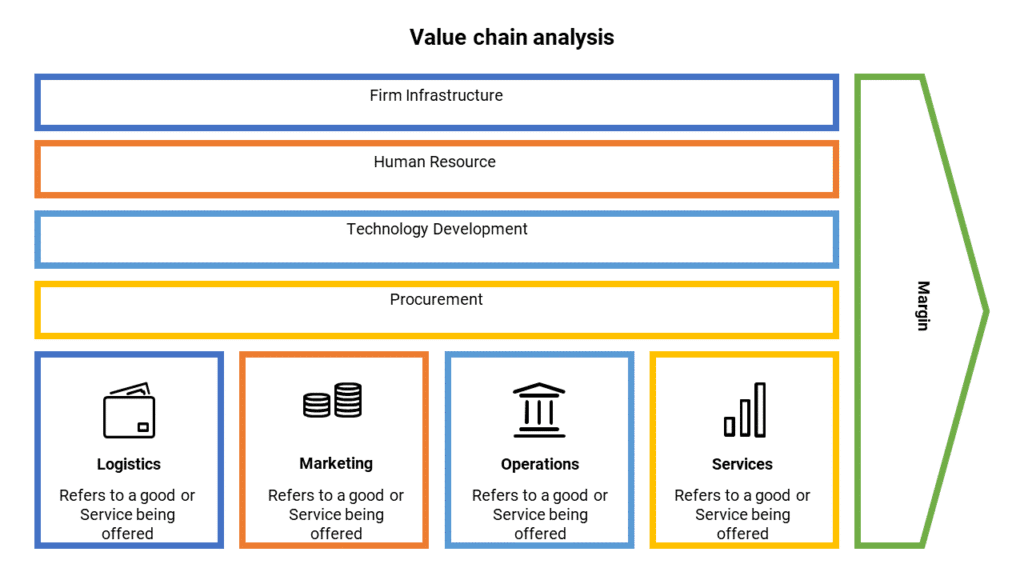

Case interview framework 10: Value Chain

A Value Chain Analysis is a concept first described and popularised by Michael Porter in his 1985 book, Competitive Advantage.

Value Chain Analysis involves identifying all the important business activities and determining which ones give the company a competitive advantage.

Also, a value chain analysis can be performed to identify potential root causes of a business problem.

For instance, a Value Chain Analysis can be undertaken by following three steps:

- Break down a company into its key activities under each heading in the model.

- Identify activities that contribute to the firm’s competitive advantage by giving it a cost advantage or creating product differentiation.

- Develop strategies around the activities that provide a sustainable competitive advantage.

Cost advantage

A business can achieve a cost advantage over its competitors by understanding the costs associated with each activity.

And then organizing each activity so that it is as efficient as possible.

Porter identified ten cost drivers related to each activity in the value chain:

1. Economies of Scale

2. Learning

3. Capacity utilization

4. Linkages among activities

5. Interrelationships among business units

6. Degree of vertical integration

7. Timing of market entry

8. Firm’s policy on targeting cost or product differentiation

9. Geographic location

10. Institutional factors (regulation, union activity, taxes, etc.)

A firm can develop a cost advantage by controlling these ten cost drivers better than its competitors.

Product differentiation

A firm can achieve product differentiation by focusing on its core competencies to perform them better than its competitors.

Product differentiation can be achieved through any part of the value chain.

For example, procurement of unique inputs and not widely available to competitors, providing high levels of product support services, or designing innovative and aesthetically attractive products.

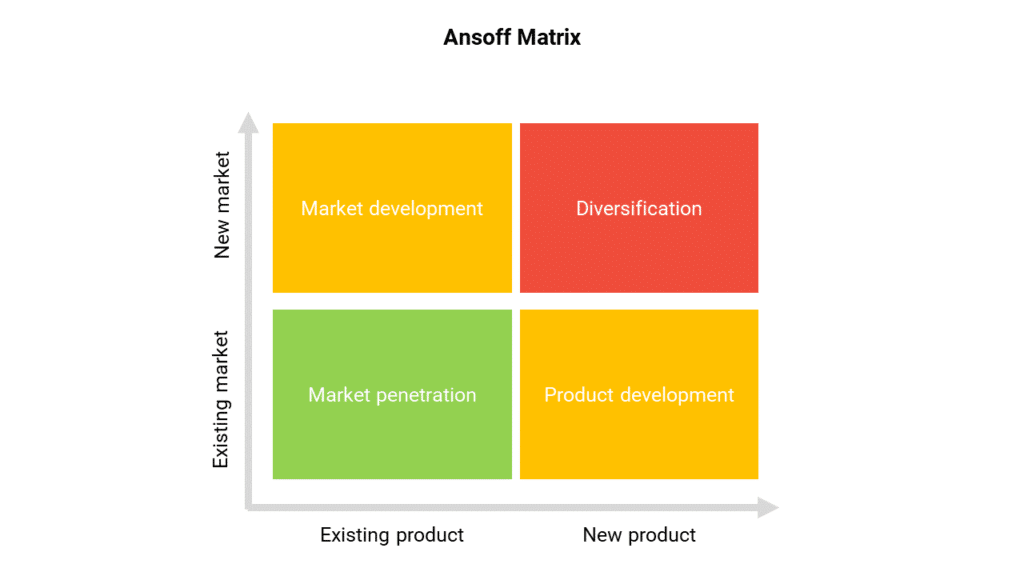

Case interview framework 11: Ansoff Matrix

The Product/Market Expansion Matrix (or “Ansoff Matrix” as it is sometimes called) was developed by a Russian-American mathematician named Igor Ansoff.

And it was first explained in his 1957 Harvard Business Review article entitled Strategies for Diversification.

The Product/Market Expansion Matrix can help a firm define a product-market growth strategy by focusing on four growth alternatives:

1. Market Penetration;

2. Market Development;

3. Product Development; and

4. Diversification.

The four alternative growth strategies are:

Market Penetration: A strategy to increase sales without departing from the original product-market strategy. This involves increasing sales to existing customers and finding new customers for existing products.

Market Development: A strategy to sell existing products to new markets (normally with some modifications). Ansoff described this as a strategy “to adapt [the] present product line … to new missions.” For example, Boeing might adapt a passenger aircraft model for cargo transportation.

Product Development: A strategy to sell new products, with new or altered features, to existing markets. Ansoff described this as a strategy to develop products with “new and different characteristics such as will improve the performance of the [existing] mission.” For example, Boeing might develop a new aircraft design with improved fuel economy.

Diversification: A strategy to develop new products for new markets, which can be related to the current business (e.g., vertical integration or horizontal diversification) or unrelated (e.g., conglomerate diversification).

Learn how to create custom case interview frameworks

The question then becomes, “How do you use business frameworks in consulting interviews?”.

On the Internet, numerous suggestions exist for how you ought to proceed.

However, the two main schools of thought are Victor Cheng’s frameworks and Marc Cosentino’s Case In Point.

However, these two approaches have one thing in common: they both attempt to impose pre defined frameworks on cases.

For instance:

For a market entry case, those resources tell you the market entry framework you should use.

And for an M&A case, those resources tell you exactly the merger and acquisition framework you should use.

In other words:

They push you to adapt the problem to your tools.

Since every case is different, this will inevitably result in average outcomes and rejections.

For instance, 10 different M&A cases should have 10 different merger and acquisition frameworks.

Another example: 10 different market entry cases should have 10 different market entry frameworks.

So, you have to learn how to create custom case interview frameworks.

You must create your own unique frameworks using First Principle Thinking.

Those case interview frameworks must be MECE.

To do so, I’ve created free training to help you in that journey.

You can sign up for free with the link below.

Get 4 Complete Case Interview Courses For Free

You need 4 skills to be successful in all case interviews: Case Structuring, Case Leadership, Case Analytics, and Communication. Join this free training and learn how to ace ANY case questions.

Case interview frameworks: Final words

I hope you enjoyed this updated guide to business frameworks.

Those consulting frameworks will help you join a top consulting firm.

Now, I’d like to hear from you:

Which frameworks from today’s guide do you use the most?

Or which frameworks are new to you?

Has this guide helped you develop your business acumen?

Let me know by leaving a quick comment below right now.

To your success,

Sébastien

P.S. Need help with your case interview preparation?

Check whether our coaching program is a good fit.

Do you know?

We have a unique coaching model and deliver amazing results.

SHARE THIS POST

Related articles

Check also these articles to ace your case interviews: