Do you struggle with market sizing questions?

This can include: How to start the case? Which clarifying questions to ask? How to organize my thoughts and build an issue tree? Which assumptions to make? Do I have to check if my estimate makes sense? If yes, how?

Answering a market sizing question (or guesstimates) can be very SIMPLE.

Actually, it is very simple: there is a PROVEN FORMULA for solving market sizing questions.

This PROVEN FORMULA is like a comprehensive guide: if you follow each step, you’ll QUICKLY answer ANY market sizing questions SUCCESSFULLY.

In this guide, I’ll reveal my PROVEN FORMULA to answer market sizing questions and show how to use it with two full examples (with answers).

Besides market sizing questions, you must know how to solve business cases to secure an offer. To help you master the ins and outs of business cases, check out this free business case course. You’ll learn how to crack any case question even if you are not a natural-born logical thinker.

Let’s dive right in.

Table of Contents

What Is A Market Sizing Question?

A market sizing question, or a guesstimate, is a specific case study where you must estimate the size of something with no (or little) data available.

- What is the smartphone market size in India?

- How many restaurants are in Paris?

- What are the annual sales of McDonald’s restaurants in China?

- How many flat-screen televisions have been sold last year in the US?

- Estimate the size of the PC market in the US

- How many coffee cups does Starbucks sell in a year?

- What volume of beer is sold during a LA Lakers basketball game?

- How many iPhones are currently being used in China?

- Estimate the monthly profit of an average hair salon in the UK

- What is Air France’s monthly Paris – New York trip revenue?

- How many school teachers are in London?

- Estimate the number of croissants sold per day on average in Paris

Get the latest data about salaries in consulting

Understand Your Interviewer's Expectations

First, let me be clear: your interviewer does NOT want you to search for the answer on Google!

Secondly, Consulting firms are NOT looking for a precise estimate but are more interested in understanding your thinking process.

For instance, this is clearly stated on the BCG website:

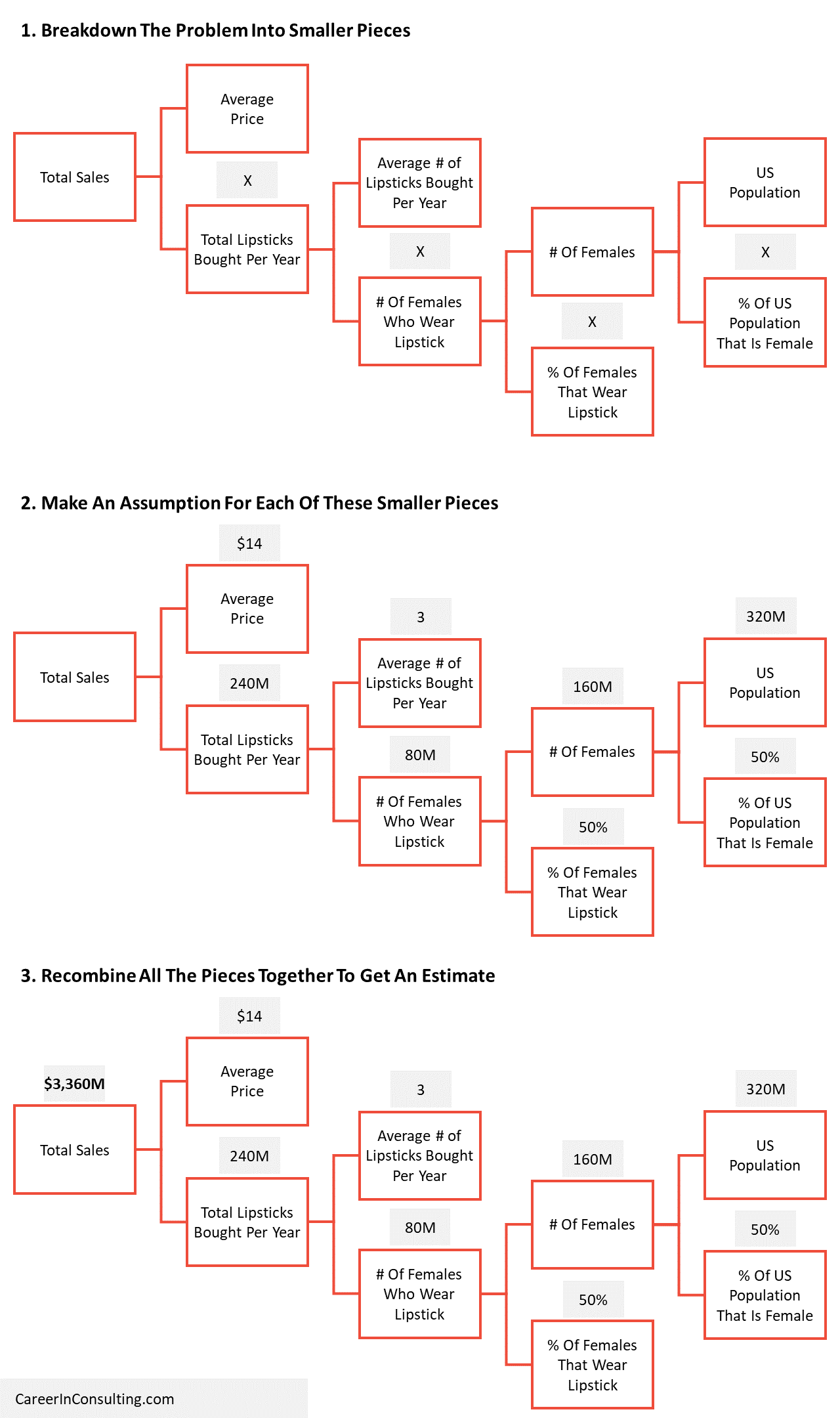

- Break down the question into smaller pieces

- Make an assumption for each of these smaller pieces

- Recombine all the smaller pieces together to get an estimate

Not only will the next chapters show you how to do it, but also how to stand out from your competition.

Ask These 6x Clarifying Questions

Market sizing questions are ALWAYS ambiguous and require clarifications.

Because Consulting firms want to see how you cope with ambiguity.

Therefore, you ALWAYS must ask clarifying questions at the beginning of the case.

#1: Clarify The Unit Of Measurement (Volume Or Value)

First, check with your interviewer if the measure to be estimated is defined as a market volume (for instance, the number of units sold in a year) or as a market value (for instance, the market size in US dollars).

Be careful: if you give an estimate in US dollars when your interviewer expects a market size in volume, you can fail your interview.

So, start by clarifying what “SIZE” means: volume or value.

Sample question: what do you mean by lipstick market size? In volume (# of lipsticks) or in value (in m$)?

#2: Clarify The Timeframe

Second, check if the estimate is for a specific period.

For instance, the last quarter or last year.

Sample question: what timeframe should I consider? A full year?

#3: Clarify The Geography

It is very unlikely that you’ll have to estimate the size of a market globally.

Instead, you are more likely to estimate the size of a market for a specific geography, such as the United States, China, or France.

So, clarify the geographical scope.

Sample question: do I have to size the market globally or for a specific geography?

#4: Clarify The Product

It’s VERY IMPORTANT and probably the MOST OVERLOOKED clarifying question.

Above all, this is where most candidates fail their interviews.

So, what does “define the product” mean?

Think of product segmentation or characteristics.

For instance, imagine you have an interview with McKinsey.

Your interviewer asks you to estimate the lipstick market size.

Is your interviewer talking about gloss lipsticks? Or matte lipstick? Which shades?

If you don’t clarify the type of lipstick, you can answer the WRONG question.

Sample question: what do you mean by “lipstick”? All types of lipsticks? All shades?

#5: Clarify The Customers

To clarify the customers means to clarify the target buyers of the product.

Think of customer segmentation or characteristics:

- B2B vs. B2C

- Age group

- Income level

- Gender

- Etc.

Sample question: who are the target customers? B2B or B2C? If B2C, for a specific age group?

#6: Clarify The Distribution Channels

Think of the relevant distribution channels for the sizing question at hand:

- Online vs. Offline

- Primary vs. Second-hand market

- Wholesalers vs. Retailers

- Etc.

Sample question: do I have to size the market for all distribution channels?

Want to learn the questions to ask to clarify a business case? Check out this free course to learn how to crack any case question.

Use This Formula To Structure An Approach

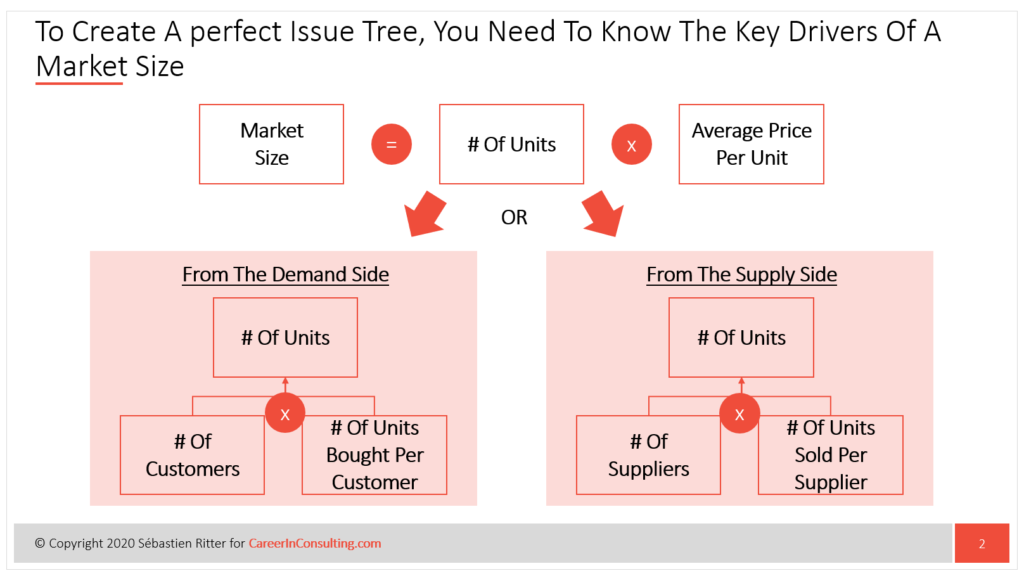

To structure an approach, you need to know the 2x key drivers of market size:

- Number of units

- Average price per unit

Plus, the number of units can be estimated from the:

- Demand side, where the number of units is equal to the number of customers x the number of units bought per customer

- Supply side, where the number of units is equal to the number of suppliers x the number of units sold per supplier

We’ll discuss in a moment how to choose between the 2x options, but for now, you can remember that 80% of the time, the demand-side approach is the best option to answer market sizing questions.

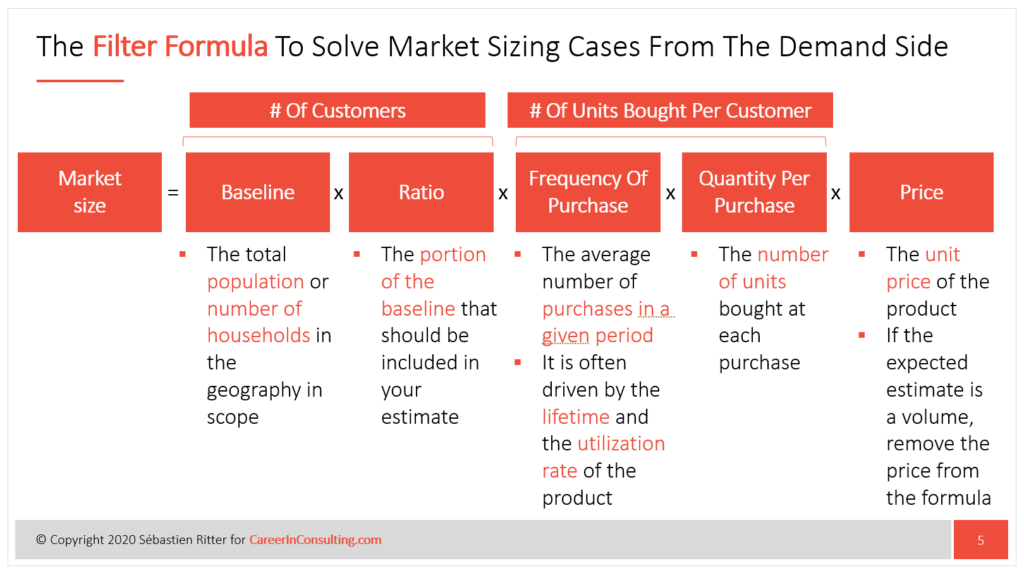

The Filter Formula To Solve Market Sizing Questions From The Demand Side

Use the Filter formula to answer a market sizing question from the demand side:

- Baseline: the population or the number of households for the geography you’ve clarified earlier

- Ratio: the baseline portion that should be included in your estimate. Most of your work is to detail this ratio

- Frequency of purchase: the average number of product purchases in a given period. It can also be called Replacement Rate, which is driven by the lifetime and the utilization rate of the product

- Quantity per purchase: the number of units bought at each purchase

- Price: This is the unit price. If the estimate is a market volume, do not include the unit price in the formula

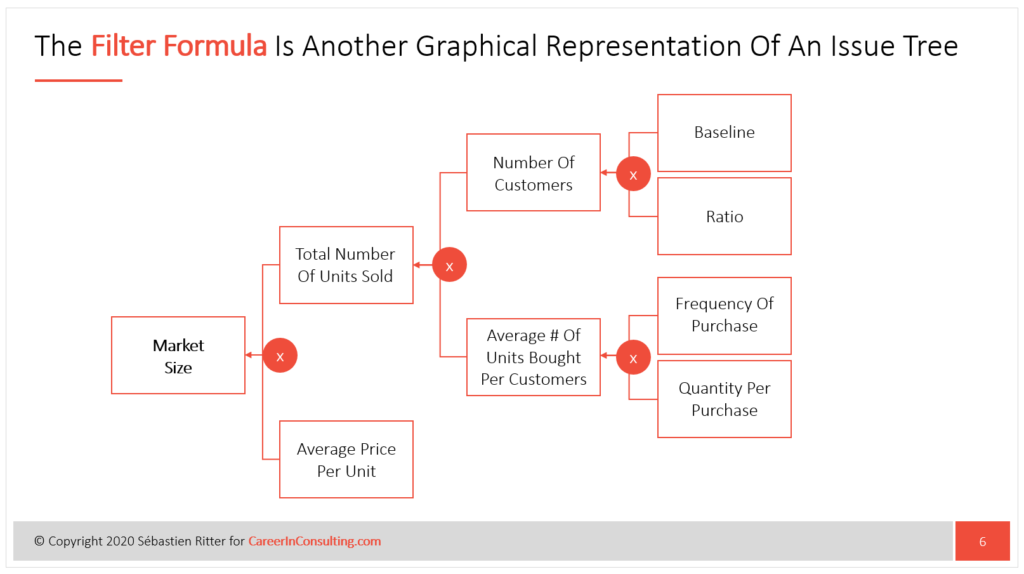

The Filter Formula is another graphical representation of an issue tree

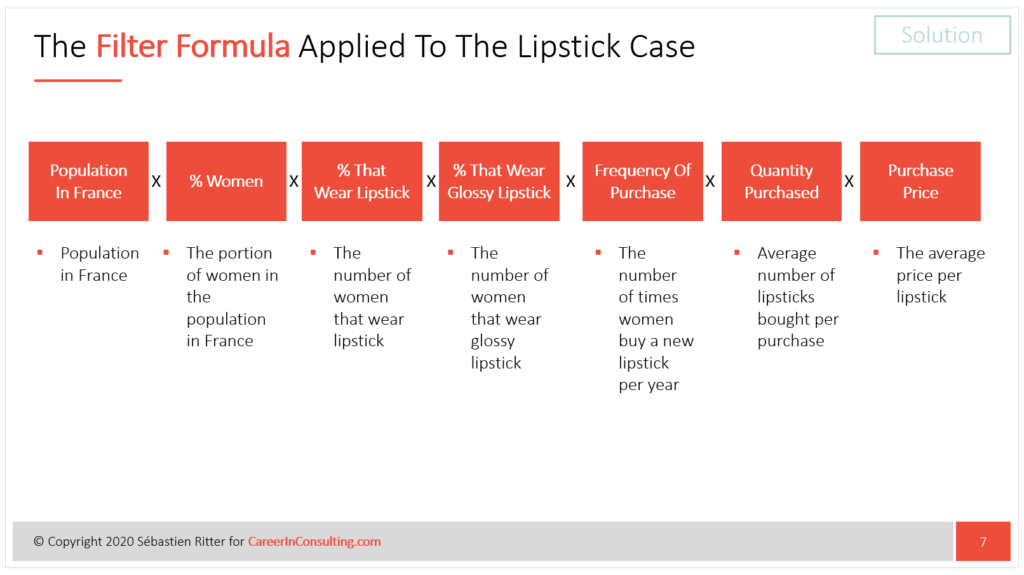

For instance, you can use the Filter Formula to estimate the glossy lipstick market size.

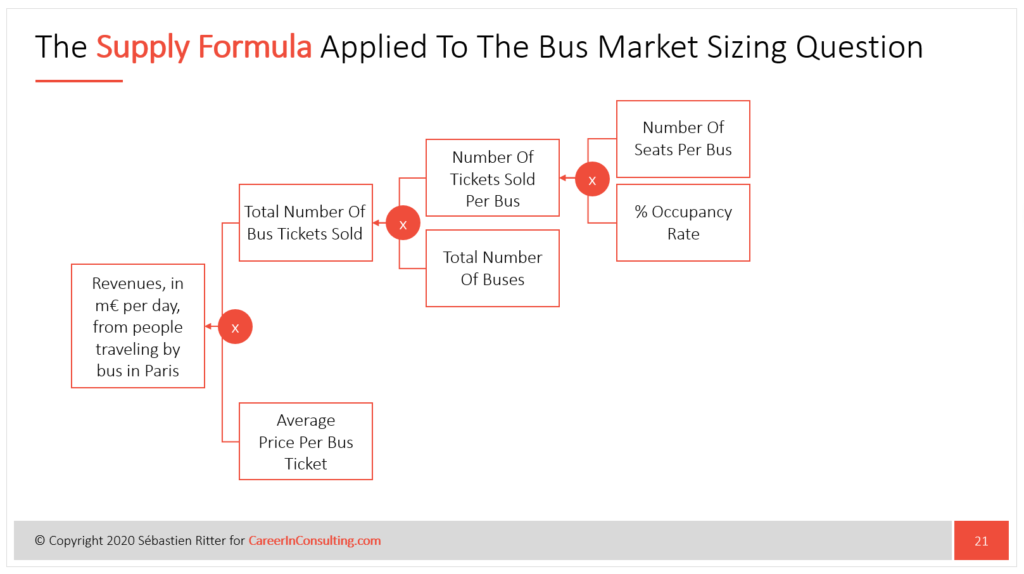

The Supply Formula To Solve Market Sizing Questions From The Supply Side

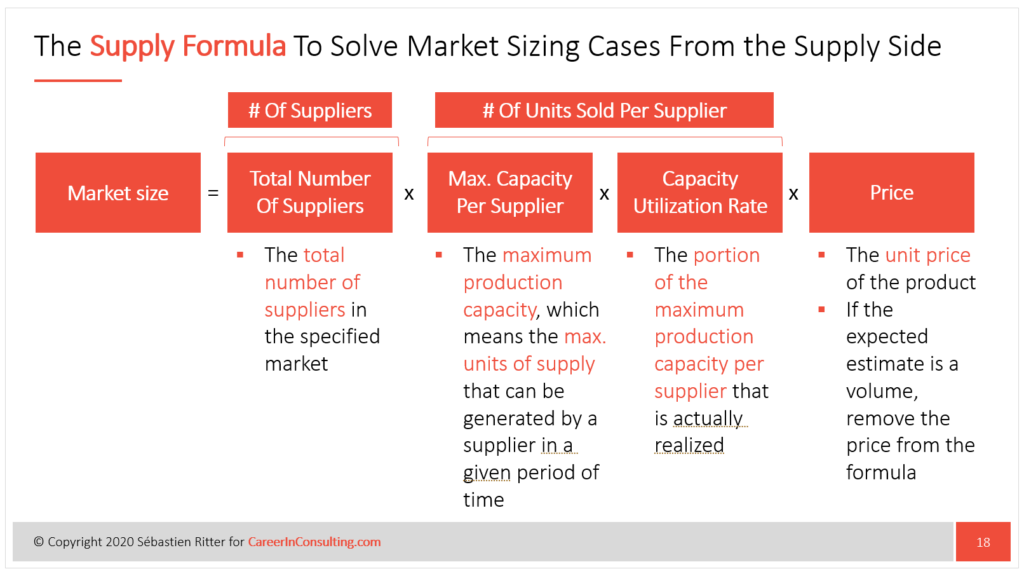

Use the Supply formula to answer a market sizing question from the supply side:

- Total number of suppliers: the total number of suppliers in the specified market

- Maximum capacity per supplier: the maximum production capacity, which means the maximum units of supply that can be produced by a supplier in a given period

- Utilization rate: the portion of the maximum production capacity per supplier that is actually realized

- Price: This is the unit price. If the estimate is a market volume, do not include the unit price in the formula

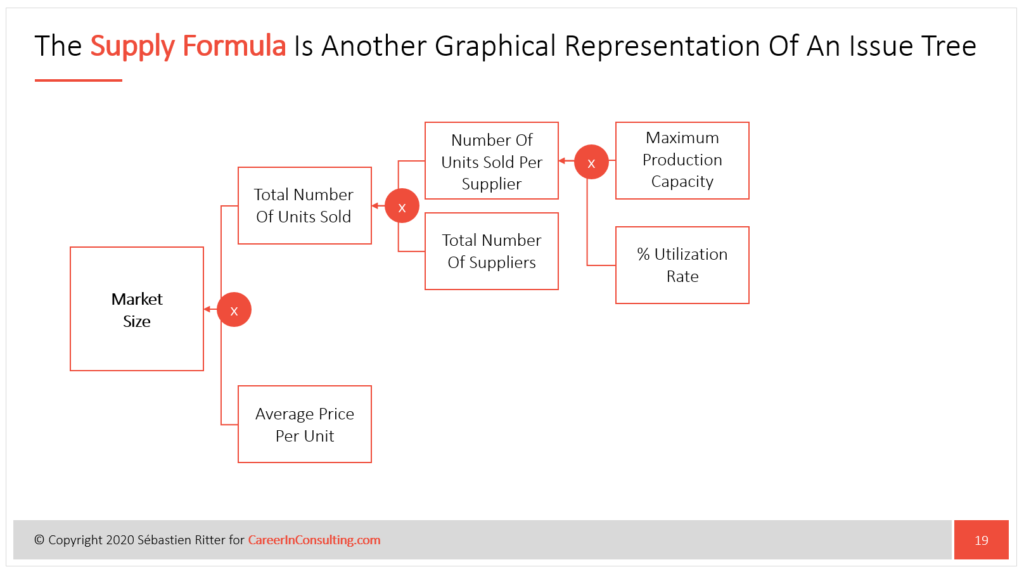

The Supply Formula is another graphical representation of an issue tree

For instance, you can use the Supply Formula to answer to following market sizing question: estimate the revenues, in million Euros per day, from people traveling by bus (using public transportation) in Paris.

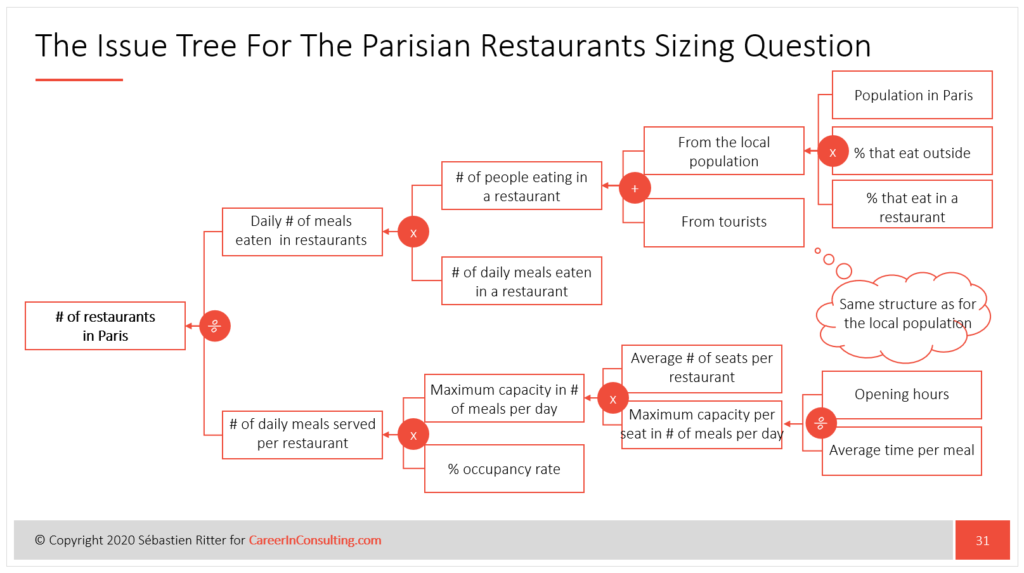

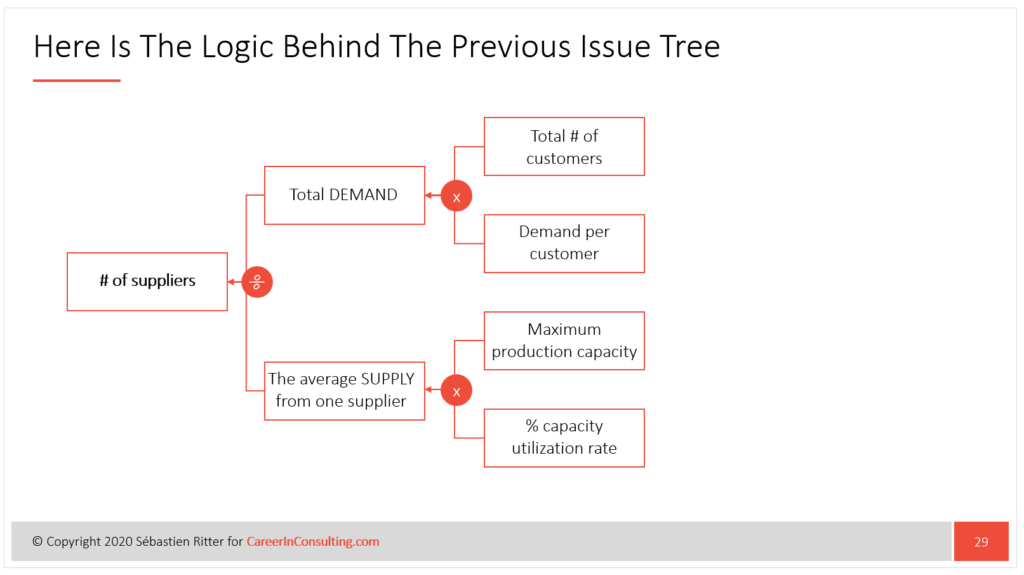

Answer Market Sizing Questions By Using A Mix Of Both Approaches

To estimate the number of suppliers, you sometimes need to mix both approaches.

For instance: estimate the number of restaurants in Paris.

Here is the logic behind the above example.

Get 4 Complete Case Interview Courses For Free

You need 4 skills to be successful in all case interviews: Case Structuring, Case Leadership, Case Analytics, and Communication. Join this free training and learn how to ace ANY case questions.

Demand Side vs. Supply Side Approach: How To Choose?

To begin with, let me be clear: you can answer a market sizing question using any of these 2x approaches.

However, depending on the market sizing question, one approach can be easier to use (80% of the time, it’s the Demand Side approach).

So now, how to choose between the 2x options?

You must consider the limiting (or bottleneck) factor to do so.

Let’s use 2x examples to understand what it means.

First, consider this market sizing question: can you estimate the volume of Pepsi-Cola consumed in the US annually?

If you want to buy a Pepsi Cola in the US, you need to go to the supermarket around the corner, and you will find a Pepsi Cola.

Because there is no limitation in supply.

Therefore, the Demand Side approach is the best option.

Secondly, let’s consider this other market sizing question: can you estimate the number of visas issued by the US embassy in Bucharest (in Romania)?

If 1000x people ask for a visa the same day, the number of visas actually issued depends on the capacity of the US embassy to proceed with the requests.

Therefore, the limiting factor is the supply. Hence, the Supply Side approach is the best option.

Make The Right Assumptions And Get An Estimate

Now it’s time to:

- Make the right assumptions for each variable of your issue tree

- Combine all the assumptions together and get an estimate

The 1x MISTAKE To Avoid At All Cost When Doing Calculations

Never pick up numbers out of nowhere without an explanation.

In other words: you must ALWAYS justify your assumptions with solid and logical explanations.

Otherwise, your assumption will only be your opinion.

Which is not consulting-friendly at all.

Make The Right Assumptions By Discussing The Underlying Drivers

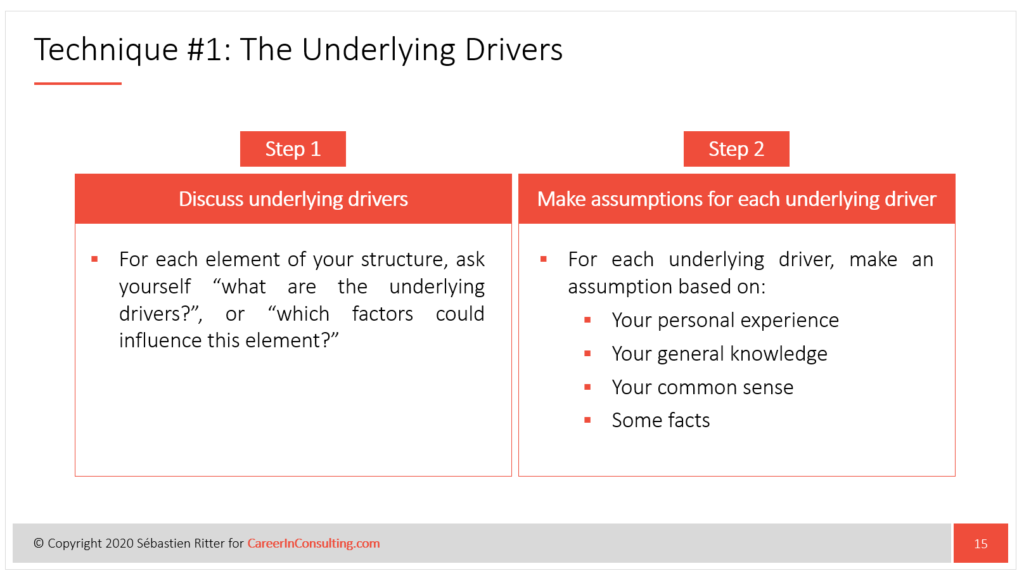

To make good assumptions, I recommend using the 2-step framework below:

For each variable in your issue tree (or each variable of the Filter Formula or the Supply Formula):

First, start by discussing the underlying drivers, which means the factors that should be considered to make an assumption.

Secondly, make an assumption based on your experience, general knowledge, common sense, or some facts you know. That’s where you show your business sense to your interviewer.

Whether your assumption is right or wrong is not that important.

Because for your interviewer, understanding how you think is much more important than getting an accurate estimate.

And, since you have discussed the underlying drivers before, you meet your interviewer’s expectations.

Make The Right Assumptions By Asking The Interviewer

If a variable of your issue tree is too “technical”, it can be difficult to discuss the underlying drivers without sounding like bullshitting your interviewer.

Thus, you can ask your interviewer for the information in this situation.

Combine All Assumptions Together And Get An Estimate

This means doing the right multiplication, division, addition, or subtraction to estimate the market size.

The challenging part here is that your interviewer will assess how accurate your calculations are and how fast you completed these calculations.

For instance, BCG clearly states “make quick and accurate calculations” on their website in the section “what we expect.”

So, speed is important.

And this can be challenging in the context of a job interview.

You can find resources on how to speed up your mental math skills here.

Close The Market Sizing Question Elegantly By Doing These 3 Things

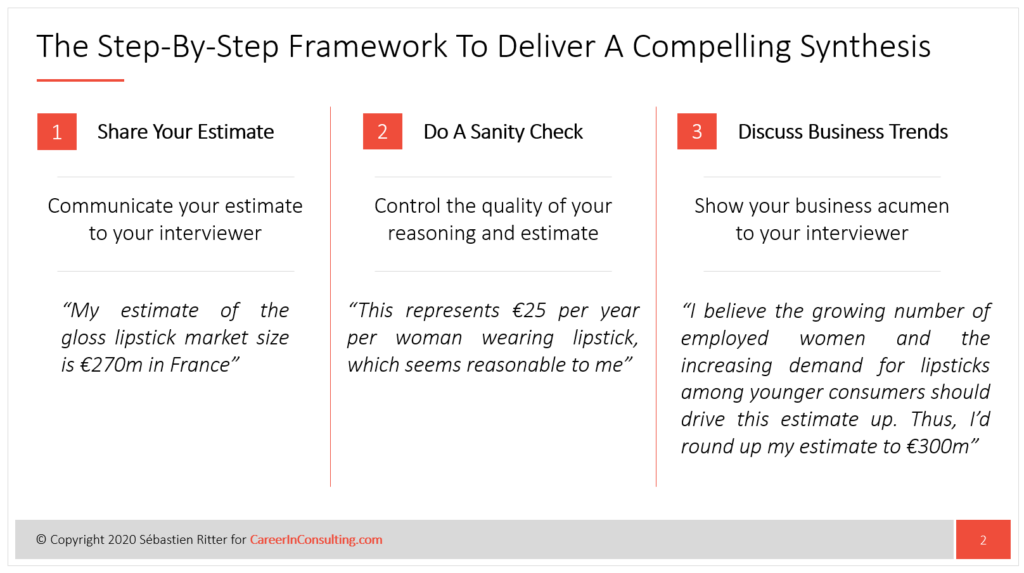

Finally, after you have estimated the market size, it’s time to communicate your answer to the interviewer.

To do so, I recommend communicating your answer to the interviewer using the 3-step framework below.

First, share the result of your calculations with the interviewer.

Then, the second step is to check that your estimate makes sense.

To do so, you must reduce your estimate to an “intuitively comparable number” (most of the time by dividing your estimate by the baseline).

For instance:

If you end up with an estimate of 60 million red cars in France, it might be difficult to feel whether this number is (too) large or not.

But if you divide this number by the number of households in France (around 30 million), you get an average of 2 red cars per household, which makes it easier to sense-check.

Lastly, showcase your business acumen by discussing potential market trends that could impact the result of your calculations.

Use This Market Sizing Cheat Sheet

How to use this market sizing cheat sheet?

Remember that this is ok to ask for this information from your interviewer.

Therefore, I don’t recommend learning by heart all the population data.

But to give a better impression, I recommend knowing at least the population data of the country where your interviews take place by heart.

Practice With these 2 Market Sizing Examples (With Answers)

Here are 2x market sizing questions examples. These are 2x full market sizing questions with answers.

Market Sizing Question Practice #1: Estimate The Contact Lens Market Size

Market Sizing Question Practice #2: Estimate Apple's Store Sales

Conclusion

Besides market sizing questions, you must know how to solve business cases to secure an offer. To help you master the ins and outs of business cases, check out this free business case course. You’ll learn how to crack any case question even if you are not a natural-born logical thinker.

Now it’s your turn.

Practice market sizing questions using the techniques described in this guide, and you will quickly improve your “guesstimates” skills.

Do you have any further questions after reading this guide?

Let me know by leaving a quick comment below right now.

Sébastien

Get 4 Complete Case Interview Courses For Free

You need 4 skills to be successful in all case interviews: Case Structuring, Case Leadership, Case Analytics, and Communication. Join this free training and learn how to ace ANY case questions.

SHARE THIS POST

Great article!

Thanks! Hope this helped…

Very well written article. Learned a lot.

Thank you Elie

To make us read a well curated article is written on maket sizing questions. It is a pleasure worth reading it. I loved reading this article. I hope you keep on updating us with such a great blog in future too.

Thank you! I’m glad you liked this article!

Hey thanks for posting this useful information about market sizing questions here, I really hope it will be helpful to many. It will help a lot; these types of content should get appreciated. I will bookmark your site; I hope to read more such informative contents in future. Appreciative content! If possible visit this website https://treetechnz.co.nz/ to gain more idea or tips on the same.

hello can I ask you a market size for courier service company?

can I have an example of market size for courier service company

What would be the market sizing question?

Thank you, the first time I can find a comprehensive article on market sizing! Nice job guys!

Thanks! glad you liked it. Check out the other articles in the blog section, they might be helpful too 😉

Simply great! Explained very well!

Thank you Devika

Bravo Sébastien, c’est de loin le meilleur site sur lequel on peut apprendre à faire des market sizing, la structure des formules change tout ! Merci !

Merci Youssef!

Thank you very much for this detailed and generous sharing! These tips and examples and your thought processes are super helpful! Thanks so much for your help!

Thank you Joanne! Glad you liked this article

Hi,

Thank you so so much for help and I have learnt a lot. However , I have some questions to ask if I may . I was practicing and trying to find the market size for the annual revenue of an e-charging station in city. May I know if my decision to use the bottom up approach to tackle this is correct? facts I know are e-cars are charged per hour and it takes an hour to fully charge the car.

I would start with the revenue of EV charging is the multiplication of total number of charging hours supplied in an e-station (daily) with the average price charged per an hour. and times with (400 days since it is annual revenue) . In order to get a total number of charing hours supplied in a day , we need to multiply maximum total number of electronic cars that a station can accommodate in a day with number hours required to fully charge an electronic car. And to get a maximum no of electronic cars a station can take is to multiply the number of vehicles per plug in a day with the number of plus.

Lets say if the operating hours is 24 hours and a car per plug takes an hour, that would give us 24 vehicles per plug daily and times with number of plugs in a station ( 5 plus, let’s say) will give the maximum capacity of 120 vehicles daily. And Each car buy take an hour to fully charge the car, that would gives us 120 hours daily. And the occupancy rate is 80% a day, so 96 hours the total no of charging hour supplied in a station and charging cost is $5 Per hour, that would give revenue of $580 a day and since we have 365 days and ( round of 400days to make the calculation easier), the yearly revenue would be S$232,000.

Hi Katrina

I’m glad you liked this article.

Re your approach: this seems ok to me (I’d use the supply-side approach as well). What is key is how you would justify the 80% occupancy rate. Plus, I’d have rounded 365d to 300 days to take into consideration the maintenance of the station.

Hope this helps,

Sébastien

taught very precisely. Thank you so much! It helped me gain some confidence with market sizing questions.

Thank you!

I have read a LOT of articles on market sizing and this one is by far the best. Thank you so much.

Thank you!

What is the smartphone market size in India?

India population-130 billion

% of people that own a phone -80% which is – 104 billion

% that own a smartphone- 50% which is – 52 billion

User replaces Smartphone approx ~2 years =26 billion

Price of smartphone about $150 which is 3.9 trillion

Market size is about $3.9 trillion

This is good. However, remember that how you justify your assumptions is as important as your structure 😉

Thank you 🙏🏾 for your response

I’ll be solving the remaining exercises and your input will be appreciated. Thanks once again for a wonderful article on market sizing !

Thank you !

How many restaurants are in Paris?

Paris population- about 2m

% of people that eat outside- 80% which is 1.6m

40% eat in a restaurant which is 640,000 people.

30% of that comes from local and 10% come from tourist which is 480,000and 160,000 respectively.

Local-About 4 of which eat in a restaurant, 3 times a week =12

480,000/12=40,000

Tourist-about 2 people eat 7 times a week =14

160,000/14=11,000

Total restaurant in Paris =51,000.

Income segment breakdown in Paris:

High = 10%

Medium = 80%

Low = 10%

Restaurant utilization by income segment

High = 3x

Medium = 1x

Low = 0x

Paris population = 2M

Locals meals taken in restaurant (daily) = (3*0.1*2M) + (1*0.8*2M) = 2.2M

Tourist utilization rate = 3x

Tourist population = (0.05*2.6M = 130k)

Tourist meals taken in restaurant (daily) = 390k

Total meals taken in restaurant (daily) = 2.59M or ~2.6M

# people a restaurant can hold = 30

peak utilization rate = 0.8 * 3 peak periods = 240%

off-peak utilization rate = 20%

# meals served in restaurants daily per restaurant = 30 * 260% = 78

# restaurants in Paris = 2.6M / 78 = 33k

Hi Sebastien, are both of these the right way to do it? The second one is more in detail. Will both pass the interview?

Sebastian, thank you a lot! you are really good at explaining from general to the detail, it was easy for me to understand, I would let you know how the interview goes haha 🙂 .. Thanks for sharing I´m sure you are helping a lot of people getting their jobs! Regards from Colombia 🙂

Thanks! Glad you liked it

Hi Sebastian!

Thank you so much for this post! I happened to come across your page 15 minutes before my interview, and I used the visual diagram of market estimation in my interview. I actually drew the diagram, and I was able to provide a very good answer based on my business intuition, framework and the quant reasoning. I was told immediately that I cleared the interview in the fintech sector, and they were very impressed that an HR person could come across so strategic! Couldn’t have done it without your hard work. Thank you so much! Lots of good Karma your way! I wish you all the success possible.

Thank you for your comment! Glad you’ve got an offer 🙂

Great article, with very clear methodology. Thank you!

Thank you for the comment!

Hi Sebastien

I have a question and I’m stuck on calculating the market size for “Concrete Pumping Services in North America”.

How can I go around with this using your approach?

Any points on this will be really helpful.

Regards,

Shiwam

Very interesting article and video !

Thank you Olivia