This is a complete guide to case interview math in 2024.

One thing is 100% sure: you’ll have to solve consulting math problems in all your case interviews at top consulting firms such as McKinsey, BCG, or Bain & Company.

This article is for you if you don’t know anything about case interview math problems or don’t feel confident about your math skills.

But if you feel confident about your case math skills, keep reading because your confidence can be your Achilles’ heel.

You don’t want to miss this guide’s detailed process and actionable tips for approaching consulting case interview math problems and securing an offer in your dream consulting firm.

Let’s jump right into it.

Table of Contents

Understanding case interview math

What is a case interview math problem?

First, let’s zoom out:

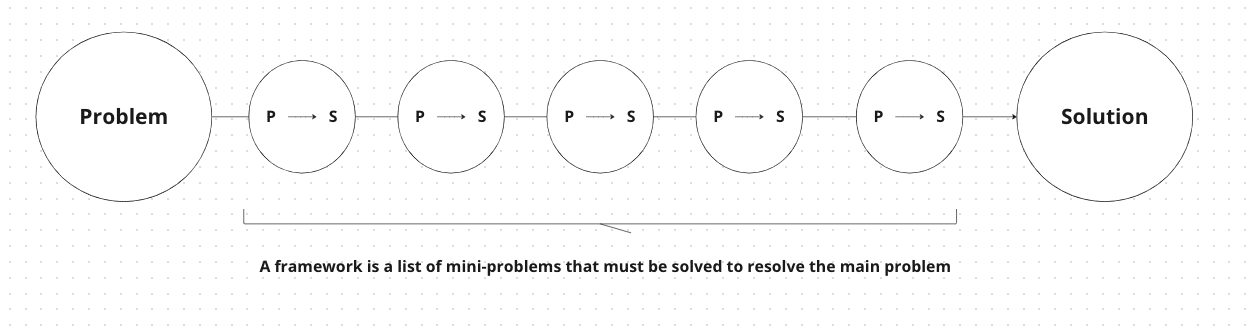

At his core, a case interview consists of identifying and solving all the mini-problems necessary to resolve the main problem.

The list of mini-problems necessary to resolve the main problem is called a framework for issue tree.

Case interview math is the practice of solving quantitative problems with the goal of solving a mini-problem of your framework. Quantitative problems involve analyzing data using basic arithmetic, percentage calculations, and business formulas.

Let’s take an example:

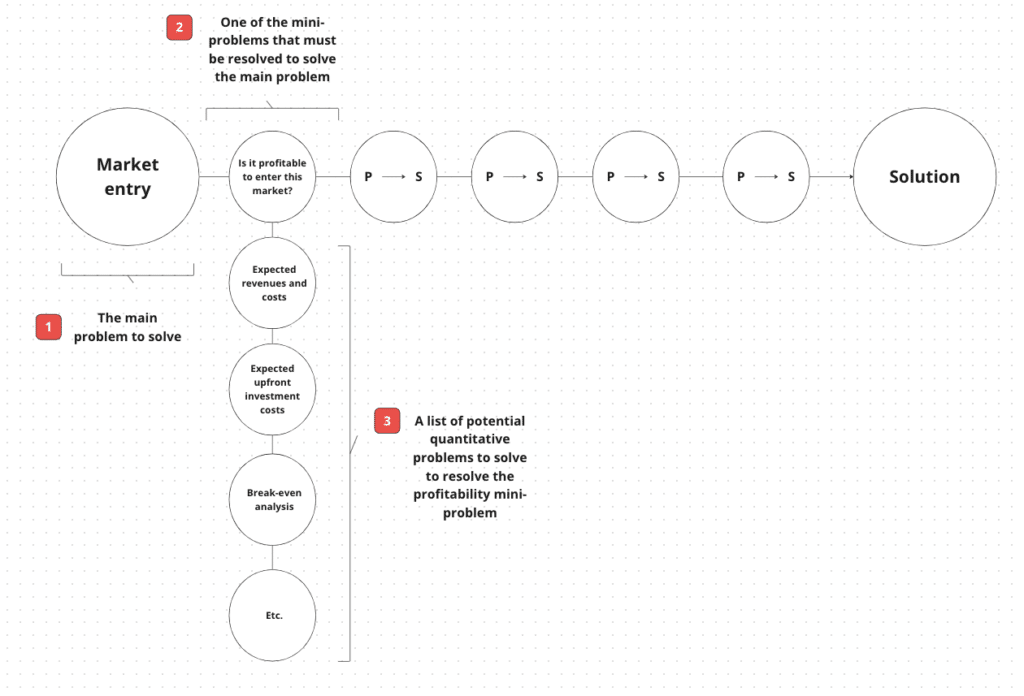

Imagine a client asking for your help assessing whether they should enter a new market (this is the main problem)

One of the mini-problems is determining if this strategy would be profitable.

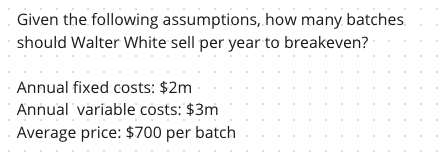

Therefore, a consulting math problem could be a break-even analysis involving estimating how many units a company should sell to make zero profit.

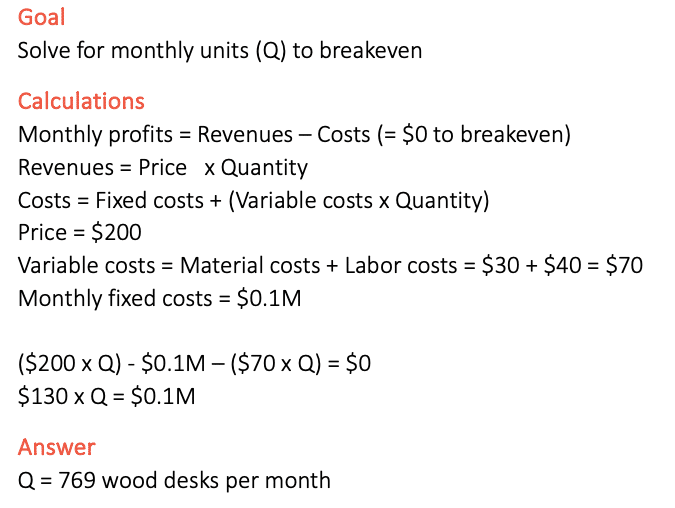

A sample case interview math problem can be a break-even analysis.

As the above image shows, a sample case interview math problem can be a break-even analysis.

For instance:

Sample case interview math problems

Here are other consulting math problems that can be asked in case interviews:

A manufacturer sells a set of headphones for $300. The cost of materials is $20, labor is $10, factory rent is $25K per month, and utilities and other operating costs are $10K per month. How many headphones would they have to sell to make a $7M profit per month?

A watch manufacturer sells watches for $220 each. To produce a watch, the company spends $20 on materials and $15 on labor. It has $0.5M in monthly operating costs. If it sells 3,000 watches per month, what is its monthly profit?

A wood desk factory sells a desk for an average price of $200. To produce each wood desk, the company spends $30 on materials and $40 on labor. They have $0.1M in monthly operating costs. How many wood desks does the factory need to sell monthly to break even?

Apple’s iPhone X retail price is $650. Should Apple reduce the price by $50? Assume COGS = $200, whatever the retail price; with a price cut, the quantity sold would increase from 5M to 6M.

What is the payback period if solar panels cost $5,000 to install and the savings are $100 each month?

Now, the next section is about what your interviewers assess.

Which skills are assessed with case interview math?

Your interviewers are testing if you possess these three consulting core skills:

Case structuring: your capacity to break down a problem into smaller and easier-to-solve problems

Case analytics (or quantitative analysis): your capacity to calculate numbers (using mental math).

Business acumen: your capacity to interpret numbers and derive conclusions from these numbers

To begin with, like every question in case interviews, you must be structured.

And consulting math problems is no exception.

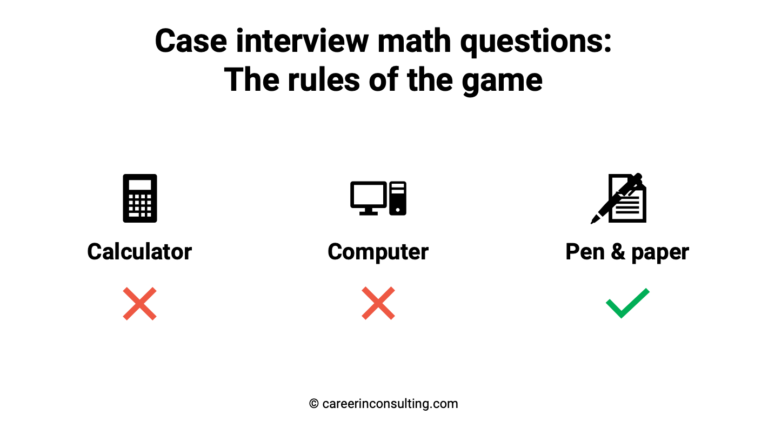

Second, to calculate numbers, you must be able to perform mental calculations, which means that calculators or computers are not allowed.

In the ChatGPT era, using mental math might sound silly.

However, management consulting firms like McKinsey, BCG, or Bain believe a strong correlation exists between candidates’ mental math ability and their chances of becoming successful consultants.

There is no turnaround: you must demonstrate good math skills to pass each consulting interview.

Finally, case interview math isn’t just about crunching numbers—it’s about unraveling the mysteries behind the data to uncover insights that drive real-world solutions.

To conclude this section, I want you to understand this:

The most challenging aspect of consulting math problems is performing calculations (fast) while someone stares at you with a $100k+ consulting job offer at stake.

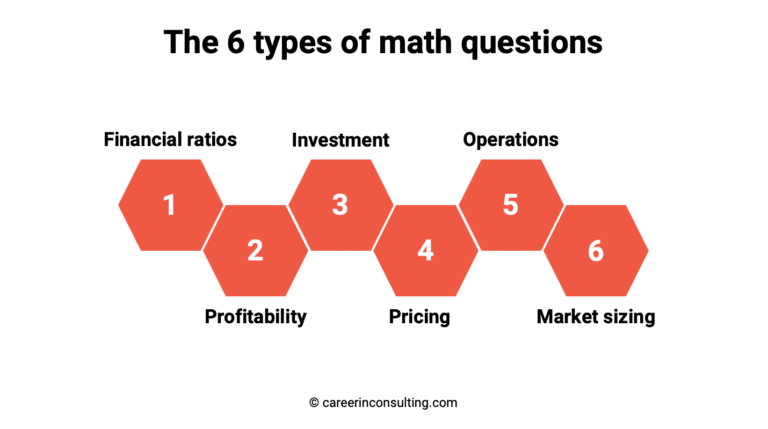

Exploring the 6 types of case interview math problems

Before we dive into the step-by-step case interview math strategies, it’s essential to know the different consulting math problems you’ll have in your case interviews.

That way, you can prepare more effectively and increase your chances of securing an offer from your dream management consulting firm.

Calculate financial ratios

Definition: Financial ratios provide insights into a company’s financial health and performance by comparing different aspects of its financial statements.

Calculating financial ratios requires analyzing data provided by the interviewer and applying mathematical formulas to derive meaningful metrics.

Example: Let’s say you’re presented with the following data for a company and asked to calculate the gross margin:

Revenue: $1,000,000

Cost of Goods Sold (COGS): $400,000

Operating Expenses: $200,000

To calculate the Gross Margin, you would use the formula:

Gross Margin = (Revenue − COGS / Revenue) × 100%

Substituting the values:

Gross Margin = (1,000,000 − 400,000 / 1,000,000) × 100% = (600,000 / 1,000,000) × 100% = 60%

So, the Gross Margin of the company is 60%.

The most common financial ratios that you might calculate in case interviews are:

Profits

Profit margin

Gross profit and gross profit margin

Operating profit and operating profit margin

Contribution margin

Solve profitability problems

Definition: Profitability problems involve assessing a company’s ability to generate profits based on the data provided.

Candidates are typically required to estimate the profit generated by a company and identify factors influencing its profitability.

Example: Suppose you’re given the following information about Company XYZ:

Revenue: $5,000,000

Total Costs: $3,000,000

To calculate the company’s profit, you would subtract total costs from revenue:

Profit = Revenue − Total Costs = $5,000,000 − 3,000,000 = $2,000,000

So, Company XYZ’s profit is $2,000,000.

Assess investment opportunities

Definition: Investment opportunity problems involve evaluating the potential returns and risks of investing in a project or opportunity.

Based on the provided data, candidates must calculate metrics such as Return on Investment (ROI), Payback Period, Net Present Value (NPV), and Breakeven Point.

Example: Imagine you’re tasked with assessing the investment opportunity for a project with the following data:

Initial Investment: $100,000

Annual Cash Inflows: $30,000

Discount Rate: 10%

To calculate the Net Present Value (NPV), you would use the formula:

𝑁𝑃𝑉=∑Cash Inflow (1+Discount Rate)𝑛 − Initial Investment

Substituting the values and summing over the project’s lifetime (let’s assume 3 years for simplicity):

𝑁𝑃𝑉 = 30,000(1+0.10)1 + 30,000(1+0.10)2 + 30,000(1+0.10)3 − 100,000

𝑁𝑃𝑉 = 27,273 + 24,793 + 22,539 − 100,000 = 74,605

So, the investment opportunity’s Net Present Value (NPV) is $74,605.

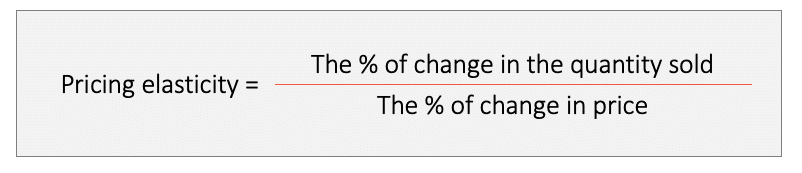

Assess pricing elasticity

Definition: Pricing elasticity problems involve understanding how price changes affect consumer demand for a product or service.

Candidates must analyze the impact of pricing changes on quantity sold, considering factors such as price sensitivity and market dynamics.

Example: Suppose you’re given data showing the following relationship between price and quantity sold for a product:

Price: $10, $15, $20

Quantity Sold: 100, 75, 50

To analyze pricing elasticity, you would calculate the percentage change in quantity sold relative to the percentage change in price.

For instance, the percentage change in quantity sold when the price increases from $10 to $15 would be:

Percentage Change in Quantity Sold=New Quantity−Old Quantity/Old Quantity×100%

Percentage Change in Quantity Sold=75−100/100×100%=−25%

This indicates a 25% decrease in quantity sold when the price increases from $10 to $15.

Solve operation problems

Definition: Operation problems involve calculating output, efficiency, or other metrics related to a business’s operational processes.

Candidates may be asked to determine the output of a production line, identify bottlenecks, or optimize resource allocation based on given input and productivity rates.

Example: Suppose you’re presented with data regarding a manufacturing plant’s production line:

Input: 1,000 units per hour

Productivity Rate: 90%

To calculate the output of the production line, you would multiply the input by the productivity rate:

Output=Input×Productivity Rate

Output=1,000×0.90=900 units per hour

So, the output of the production line is 900 units per hour.

Answer market sizing questions

Definition: Market sizing questions involve estimating the size of a market or segment based on limited or no information provided.

Candidates must make assumptions and use logical reasoning to arrive at a plausible estimate, demonstrating their ability to think critically and analyze market dynamics.

Example: Let’s consider a scenario where you’re asked to estimate the size of the online grocery delivery market in a specific city.

Given the lack of precise data, you would need to make several assumptions based on available information, such as population size, average household spending on groceries, and the percentage of the population likely to use online grocery services.

Assuming the city has a population of 1 million, with an average household spending of $200 on groceries per month, and an estimated 20% of households using online grocery services, you could estimate the market size as follows:

Market Size=Population×Average Household Spending×Percentage of Households Using Online Grocery Services

Market Size=1,000,000×$200×0.20=$40,000,000

So, the estimated size of the online grocery delivery market in the city is $40 million.

Related article: I’ve written a comprehensive guide about market sizing and market math here.

Strategies to Master Case Interview Math Problems

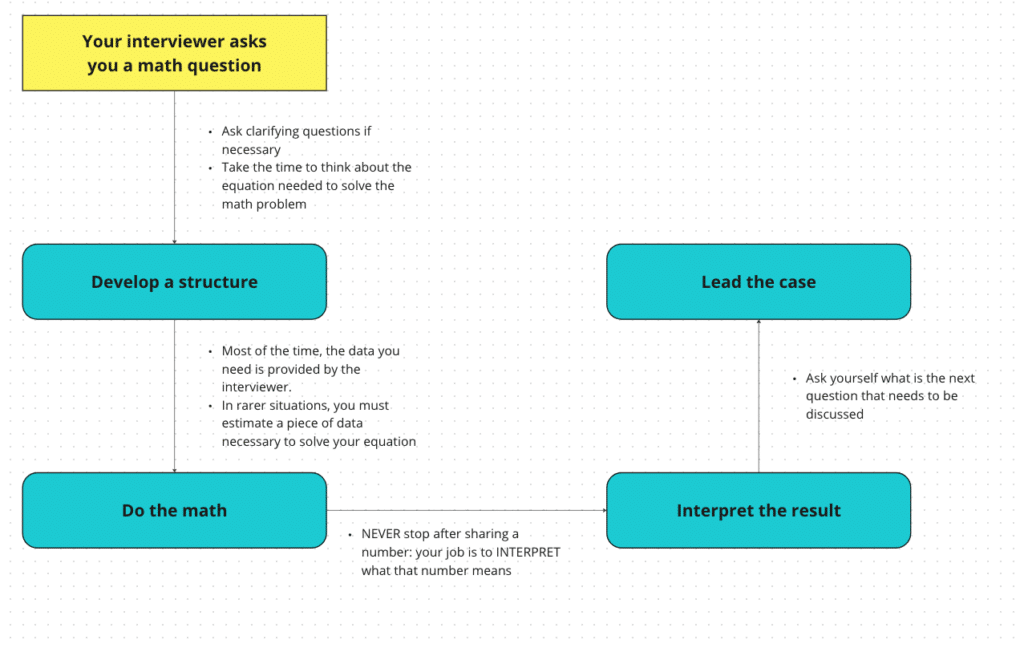

The step-by-step approach to solving case interview math problems

Solving consulting math problems goes beyond performing calculations.

Indeed, consulting companies want to see if you have the mental agility to become a world-class consultant.

Therefore, these firms expect you to solve consulting case interview math problems using the following process:

Develop a structure

Do the math

Interpret the result

Lead the case

Step 1: structure your approach

The first step consists of mapping out your approach to answer the question.

Often, you need to use a business formula to structure your approach.

Therefore, check the most helpful business concepts and formulas mentioned later in this guide.

Important: you can get unclear case interview math problems. Therefore, if it’s the case, start by asking your interviewers clarifying questions.

Step 2: do the calculations

This is when you plug the data provided by your interviewers into your formula.

Finally, do a quick sanity check after you’ve performing calculations and found the final result.

Step 3: derive insights (the "so-whats")

Remember this: your job as a consultant is not to calculate data but to interpret data.

You must relate your answer to the problem to be solved and discuss the implications of your calculations for your client or the problem.

These implications are known as the “so-whats” in consulting.

Imagine this:

You did a break-even analysis and found that your client must sell 100,000 units to break even.

Now, you must discuss the implications of these findings.

For instance:

Is it doable?

Can we reduce the breakeven point?

Step 4: lead the case

Finally, discuss the possible next steps in the case interview, i.e., what is the next information you want to know or analysis to do.

Do not overthink the differences between candidate-led and interviewer-led cases.

Instead, ALWAYS lead the case. You’ll stand out and impress your interviewers (and thank me later).

Time Management Tips for Case Interview Math Problems

Efficient time management is crucial during math sections of consulting case interviews, as you are often under pressure to demonstrate analytical precision swiftly.

Practice with a timer to understand how long different types of questions take you to solve.

Always keep track of your time on each problem and set internal benchmarks to ensure you’re not falling behind.

If you find yourself stuck, it’s wise to move on and return later if time permits rather than getting bogged down and risking the completion of more straightforward questions that could yield quick wins.

Tips for Effective Case Interview Math Practice

Structured and consistent practice is key to excelling in case interview math.

Start by familiarizing yourself with common math problems in consulting cases, such as profitability calculations or market sizing.

Use various resources, from online practice problems to case books, to expose yourself to a wide range of question formats and difficulty levels.

Simulate the interview environment as closely as possible during practice sessions by timing yourself and working in a quiet space.

After each session, critically review your solutions to identify errors or inefficiencies in your approach.

Get 4 Complete Case Interview Courses For Free

You need 4 skills to be successful in all case interviews: Case Structuring, Case Leadership, Case Analytics, and Communication. Join this free training and learn how to ace ANY case questions.

8 math techniques you must know to ace case interview math problems

You don’t need to know complex math concepts to answer consulting math problems.

Knowing how to add, subtract, multiply, and divide is enough.

Okay, knowing some basic business formulas helps, too.

But don’t panic: if you don’t have a business degree, this article is what you need.

Therefore, I’ll share all the business formulas you need to ace consulting math problems later.

But let’s go back to the math techniques you must know.

Even if knowing basic arithmetics is enough, you must have some strategies to quickly answer math questions in a stressful context like case interviews.

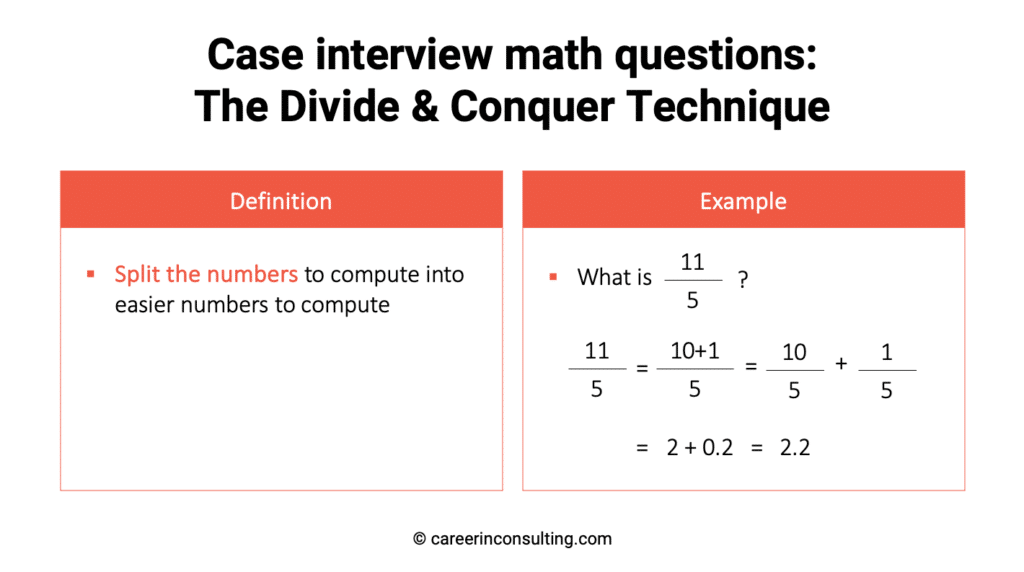

Let’s jump into the first strategy: divide and conquer.

The divide and conquer technique

The divide and conquer consists of breaking down complex math calculations into manageable parts with easier-to-compute numbers.

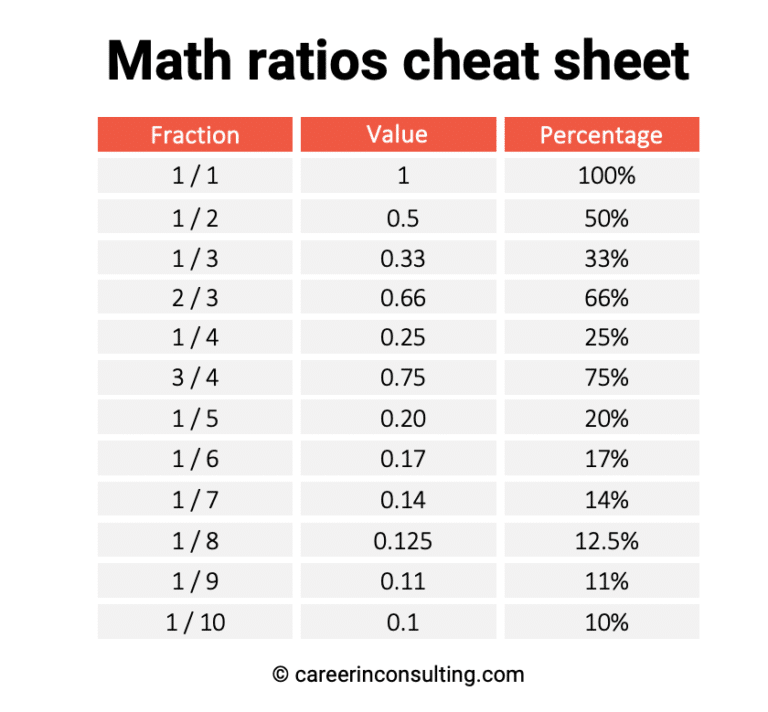

The math ratios cheat sheet

You need to memorize very few things when preparing for your case interviews.

However, memorizing the following cheat sheet will help improve your mental math skills.

In other words: this is a list of critical numbers to know to fasten your mental calculation skills.

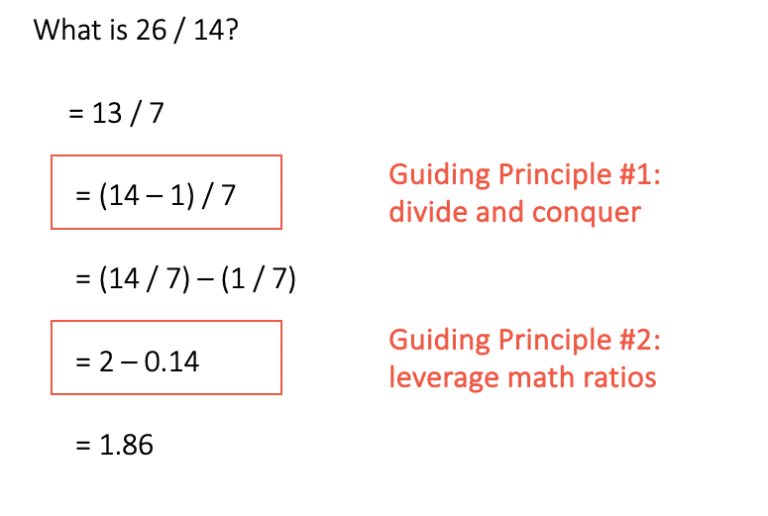

Now, you can use the last two concepts to fasten your mental skills.

Example: What is 26/14? Give an exact answer.

Answer:

Percentage calculations

1. Calculate A% of B:

Calculating A% of B involves finding a fraction of B represented by A%.

In consulting math problems, this calculation is essential for understanding proportions and applying them to various scenarios.

Example: Imagine you’re analyzing the cost savings achieved by implementing a new efficiency measure in a manufacturing plant.

The total cost savings amount to $10,000, and you need to calculate 20% of this total.

20% of $10,000 = 0.20 x $10,000 = $2,000

So, 20% of $10,000 is $2,000.

2. Calculate What Percentage of A is B:

Determining what percentage of A a value B represents allows consultants to contextualize data and understand its significance relative to a reference point.

Example: Suppose you’re analyzing the revenue contribution of a specific product line within a company’s overall sales.

If the product line generates $25,000 in revenue out of a total company revenue of $100,000, you can calculate the percentage of total revenue represented by the product line as follows:

Percentage of Total Revenue=(Revenue of Product Line/Total Revenue)×100%

Percentage of Total Revenue=($25,000/$100,000)×100%=25%

So, the product line represents 25% of the company’s total revenue.

3. Calculate Percentage Change:

Calculating percentage change allows consultants to assess the magnitude and direction of changes over time, providing insights into trends and performance metrics.

Example: Consider a scenario where you’re analyzing a retail company’s year-over-year growth in sales revenue.

If the company’s sales revenue increased from $50,000 last year to $60,000 this year, you can calculate the percentage change in revenue as follows:

Percentage Change=(New Value−Old Value/Old Value)×100%

Percentage Change=($60,000−$50,000/$50,000)×100%=20%

So, there was a 20% increase in sales revenue compared to last year.

Averages (or Means)

The mean, also known as the arithmetic average, is a fundamental concept in statistics and mathematics.

It represents the sum of all values in a dataset divided by the total number of values.

In the context of consulting math problems, understanding the mean allows candidates to analyze and interpret numerical data effectively.

Example: Suppose you’re analyzing a retail company’s average revenue per customer.

You’re provided with the following data:

Revenue from Customer A: $500

Revenue from Customer B: $700

Revenue from Customer C: $600 To calculate the mean revenue per customer, add up the revenues and divide by the total number of customers: Mean Revenue = $500+$700+$6003=$18003=$600Mean Revenue = $3$500+$700+$600 = $31800=$600

So, the mean revenue per customer is $600.

Another example: Consider a scenario where you analyze a tech company’s average response time for customer service inquiries.

You’re provided with the following data:

Response Time for Inquiry 1: 5 minutes

Response Time for Inquiry 2: 10 minutes

Response Time for Inquiry 3: 15 minutes. To calculate the average response time, add up the response times and divide by the total number of inquiries: Average Response Time = 5+10+153=303=10Average Response Time = 35+10+15 =330 =10.

So, the average response time for customer service inquiries is 10 minutes.

Weighted average

The weighted average is a calculation that considers the importance or weight of each value in a dataset.

It’s particularly useful in consulting math problems where certain data points may have greater significance or influence the overall analysis.

Example: Imagine you’re analyzing the average score of products in a customer satisfaction survey, where each product category represents a different proportion of sales revenue.

You’re provided with the following data:

Product A (50% of sales revenue): Average score of 4.5 out of 5

Product B (30% of sales revenue): Average score of 4.2 out of 5

Product C (20% of sales revenue): Average score of 4.8 out of 5

To calculate the weighted average score, multiply each average score by its corresponding sales revenue proportion, then sum the results:

Weighted Average Score = (0.5×4.5)+(0.3×4.2)+(0.2×4.8)

Weighted Average Score =(2.25)+(1.26) +(0.96)=4.47

So, the weighted average score of products in the customer satisfaction survey is 4.47 out of 5.

Fasten mental calculations: addition and substraction

Let’s use the above techniques (particularly the divide-and-conquer technique) to strengthen our mental calculation skills.

Let’s start with addition and subtraction.

I’ve found this great YouTube video from the Math0genius channel:

Fasten mental calculations: multiplication

Let’s continue with multiplication.

You can watch the following video from the same YouTube channel:

Fasten mental calculations: division

Finally, let’s end with division.

You can watch the following video from the same YouTube channel:

12 business formulas you must know to ace case interview math problems

In the following sections, you’ll learn the consulting math formulas and concepts all aspiring consultants must know to solve consulting math problems.

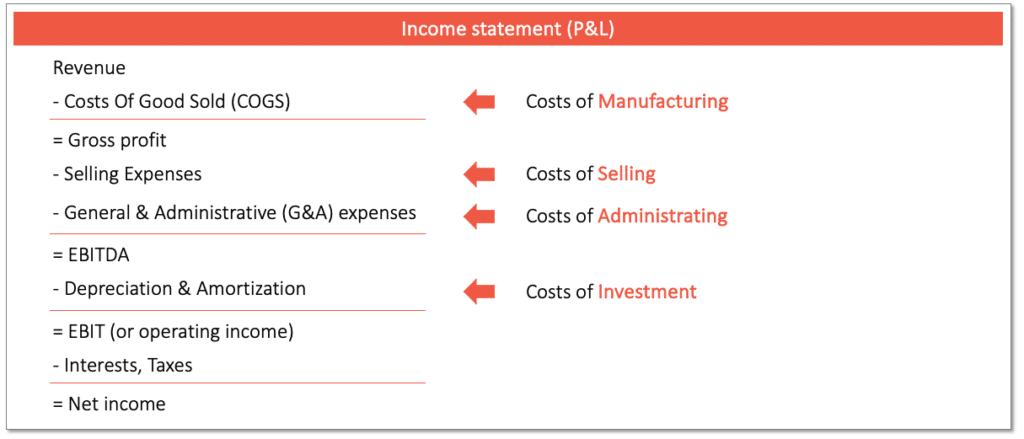

The income statement (P&L)

An income statement (or Profit&Loss statement) is one of the financial statements used for reporting a company’s financial performance.

In income statements, you’ll find:

COGS: costs of goods sold: it includes the costs of material and labor directly used to manufacture the products; COGS are variable costs

SG&A: selling, general & administrative expenses. It includes:

Selling expenses include the costs to sell (marketing expenses, salaries of sales personnel) and to distribute the products; they’re partly fixed and variable costs

G&A expenses include the costs to manage the company (labor costs for IT, HR, etc. + Rent + Utilities, etc.); G&A expenses are fixed costs

Profit

Profit is the financial benefit realized when revenue from a business activity exceeds costs and taxes.

In a case interview, you might be asked to calculate the profit using the profit equation, given some information about revenues and costs.

The profit equation is Profit = Revenues – Costs, where:

Revenues = quantity sold x unit price

Costs = variable costs + fixed costs

Example: What were the profits generated by your client last year if they sold 1,000,000 units for $5 per unit and had variable costs of $2.5m and fixed costs of $1m?

Answer: Its profits last year were (1,000,000 x $5)—($2.5m + $1m) = $5m—$3.5 m = $1.5m.

Gross profit

Gross profit is sales minus the cost of goods sold.

The cost of goods sold (COGS) refers to the costs related to producing a company’s products (or services).

COGS exclude costs related to sales, marketing, and administrative activities.

For example, if a company generates $1m of sales and has COGS of $0.7m, its gross profit is $0.3m.

Gross profit margin

Gross profit margin is the gross profit as a percentage of sales.

The gross profit margin formula is:

Gross profit margin = gross profit/sales.

Example: if a company generates $1m of sales and $0.3m of gross profit, its gross profit margin is 30%.

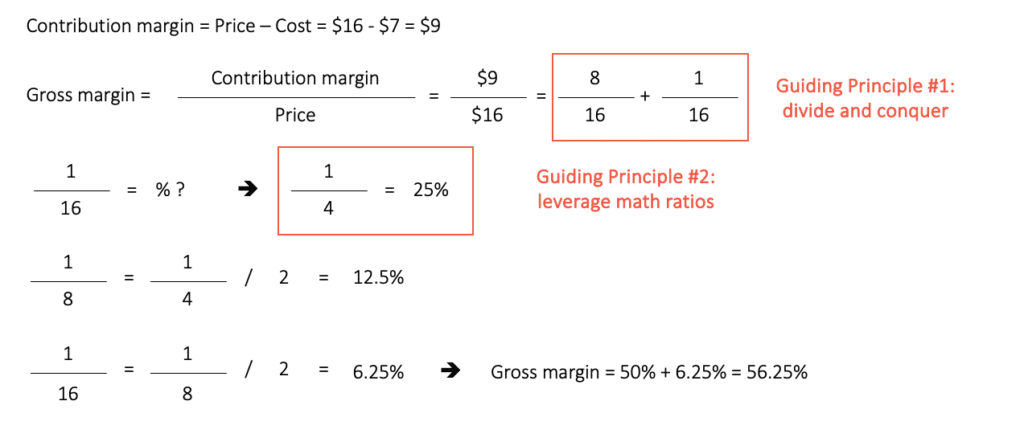

Another example: Your client sells electronic devices for $16 per unit. The manufacturing cost is $7 per unit. What is the gross margin (in % of selling price)? Give an exact answer.

Answer:

Operating profit

Operating profit is the gross profit minus the operating expenses.

Operating expenses include costs related to sales, marketing, and administrative activities.

It excludes costs related to taxes.

Example: if a company generates $0.3m of gross profit and has operating costs of $0.1m, its operating profit is $0.2m.

Operating profit margin

Operating profit margin is the operating profit as a percentage of sales.

The operating profit margin formula is:

Operating profit margin = operating profit/sales.

Example: if a company generates $1m of sales and $0.1m of operating profit, its operating profit margin is 10%.

Contribution margin

Contribution margin is vital in business and finance, especially in management consulting, where precise financial analysis is paramount.

It represents the portion of sales that exceeds variable costs and contributes to covering fixed costs.

In simpler terms, contribution margin reveals how much revenue from each unit sold is available to cover fixed expenses and generate profit.

To calculate contribution margin, subtract variable costs (such as direct materials and labor) from sales revenue.

Understanding contribution margin is crucial for making informed pricing strategies, product mix, and overall profitability decisions.

Example:

Let’s envision a consulting math problem that embodies the concept of contribution margin in a case interview scenario at a top consulting firm.

Suppose you’re tasked with analyzing the financial performance of a client’s product line and advising on potential pricing adjustments.

Here’s the scenario:

Company XYZ sells a product for $50 per unit.

Variable costs per unit, including materials and labor, amount to $20.

Fixed costs associated with production, such as rent and salaries, total $100,000 per month.

To calculate the contribution margin per unit, subtract variable costs from the selling price:

Contribution Margin per Unit=Selling Price−Variable Costs

Contribution Margin per Unit=$50−$20=$30

Now, we can determine the contribution margin ratio by dividing the contribution margin per unit by the selling price:

Contribution Margin Ratio=Contribution Margin per Unit/Selling Price×100%

Contribution Margin Ratio=$30/$50×100%=60%

This means that for every dollar of sales revenue generated, $0.60 contributes to covering fixed costs and generating profit.

In this scenario, understanding the contribution margin allows consultants to assess the impact of potential price changes on the company’s profitability.

By optimizing the contribution margin, businesses can make strategic decisions to enhance financial performance and achieve sustainable growth.

Breakeven analysis

A break-even analysis tells you how many units a company must sell to reach its breakeven point, i.e., to make $0 of profit.

In other words, a breakeven point is when the costs equal revenues.

Given that:

Revenue = Price x Quantity

Costs = Fixed costs + (variable costs x quantity)

Therefore, the breakeven point is:

Breakeven = (fixed costs)/(price – variable costs) = (fixed costs)/(unit contribution margin)

Example: A wood desk factory sells a desk for an average price of $200. To produce each wood desk, the company spends $30 on materials and $40 on labor.

They have $0.1M in monthly operating costs. How many wood desks must the factory sell monthly to break even?

Answer:

Return on investment (ROI)

The return on investment (ROI), expressed as a %, is the ratio between the profit generated by an investment and the initial capital invested.

The higher the ROI of an investment, the better the investment is performing.

An ROI is easy to calculate and helps benchmark and comparison purposes.

The ROI formula is as follows: (gain from the investment)/(the capital invested)

Example: An investor purchased a property for $500K. Two years later, the investor sells the property for $750K. What is the ROI of this investment?

Answer: The ROI is ($750K – $500K) / $500K = 50%, meaning each $1 invested earned $1.5.

Payback period

The payback period, expressed as a number of years, is the amount of time it takes to recover the cost of an investment.

In other words, the payback period is the length of time an investment reaches a breakeven point.

Shorter paybacks mean more attractive investments

The payback period formula is as follows:

Payback period = (cost of the investment)/(net annual cash inflows)

For instance, if a company invests $300,000 in a new production line, and the production line then produces a positive cash flow of $100,000 per year, then the payback period is 3.0 years ($300,000 initial investment ÷ $100,000 annual payback).

Market share

A market share represents the percentage of the total market a company has.

And a market share can be measured in value or volume.

Example: if your client generates $1m of sales in a market estimated at $10m, its (value) market share is 10%.

Another example: your client sells 10,000 units per year, and the market is estimated at 1 million units sold per year.

Therefore, your client’s market share (in volume) is 1%.

Pricing elasticity

Pricing elasticity measures consumers’ responsiveness to a change in a product’s price; higher price elasticity suggests that consumers are more responsive to price changes.

Pricing elasticity is defined as:

For instance:

A company sells 300 million cigarettes at $8 per pack

The price elasticity for cigarettes is -0.3, which means that for every 1% rise in price, the quantity sold decreases by -0.3%

If the company raises prices from $8 to $10 per pack (+25% change in price), they can expect a drop of 22.5 million in sales (-7.5% change in quantity sold)

Practice drills for case interview math (with answers)

You can practice using the following case interview math practice drills in this chapter.

Want the answers?

Sign up using this form, and you’ll receive the answers to all the case interview math practice drills.

Mental calculations: addition and substraction

- Calculate: 457+238

- Calculate: 891−364

- Calculate: 1,245+987

- Calculate: 3,568−1,234

- Calculate: 6,789+2,345

- Calculate: 9,876−5,432

- Calculate: 12,345+6,789

- Calculate: 15,678−9,876

- Calculate: 23,456+8,765

- Calculate: 29,876−12,345

Mental calculations: multiplication

- Calculate: 12×14

- Calculate: 23×15

- Calculate: 35×18

- Calculate: 48×22

- Calculate: 56×29

- Calculate: 67×31

- Calculate: 72×35

- Calculate: 85×39

- Calculate: 96×42

- Calculate: 109×47

Mental calculations: division

- Calculate: 294÷7

- Calculate: 512÷8

- Calculate: 735÷5

- Calculate: 896÷4

- Calculate: 1,023÷9

- Calculate: 1,298÷6

- Calculate: 1,587÷3

- Calculate: 1,824÷8

- Calculate: 2,045÷7

- Calculate: 2,387÷5

Calculate financial ratios

- Calculate the Gross Margin given Revenue of $15,000 and Cost of Goods Sold (COGS) of $7,500.

Solve profitability problems

- Estimate the Profit Margin for a company with $50,000 in Net Income and $500,000 in Revenue.

- Determine the Return on Investment (ROI) for an investment of $10,000 that generates a profit of $2,000.

- Calculate the Operating Margin for a company with $75,000 in Operating Income and $300,000 in Revenue.

Assess investment opportunities

- Calculate the Payback Period for an investment of $50,000 that generates annual cash flows of $10,000.

- Determine the Net Present Value (NPV) for an investment with an initial cost of $100,000 and cash flows of $30,000 annually for 5 years, assuming a discount rate of 10%.

- Calculate the Return on Investment (ROI) for an investment of $80,000, generating a net profit of $20,000.

Assess pricing elasticity

- Analyze the impact on quantity sold if the price of a product increases from $10 to $12, given that the amount sold decreases from 1,000 units to 800 units.

- Determine the price elasticity of demand if a 10% decrease in price leads to a 15% increase in quantity sold.

- Analyze the impact on revenue if the price of a product increases from $20 to $25 and the quantity sold decreases from 500 units to 400 units.

Solve operations problems

- Calculate the output of a production line that processes 500 units per hour with an efficiency rate of 80%.

- Determine the total cost of producing 1,000 units with a variable cost per unit of $5 and fixed costs of $2,000.

- Calculate the capacity utilization rate of a factory that can produce 1,200 units per day but currently produces 800 units per day.

McKinsey case interview math problems

Do you want to practice with four real-life case interview math questions recently used in McKinsey interviews?

I have prepared a 2-hour video presenting detailed solutions to these questions.

Fill out the following form, and I’ll send you the video.

After you sign up, you’ll get the answers to all the above case interview math practice drills.

Case interview math: final words

This is my guide to consulting case interview math in 2024.

Which concepts or formulas from today’s guide have you heard about for the first time?

After reading this guide, do you feel more confident about your consulting math skills?

Or maybe you have a question about something from this article.

Either way, let me know by leaving a quick comment below.

Get 4 Complete Case Interview Courses For Free

You need 4 skills to be successful in all case interviews: Case Structuring, Case Leadership, Case Analytics, and Communication. Join this free training and learn how to ace ANY case questions.